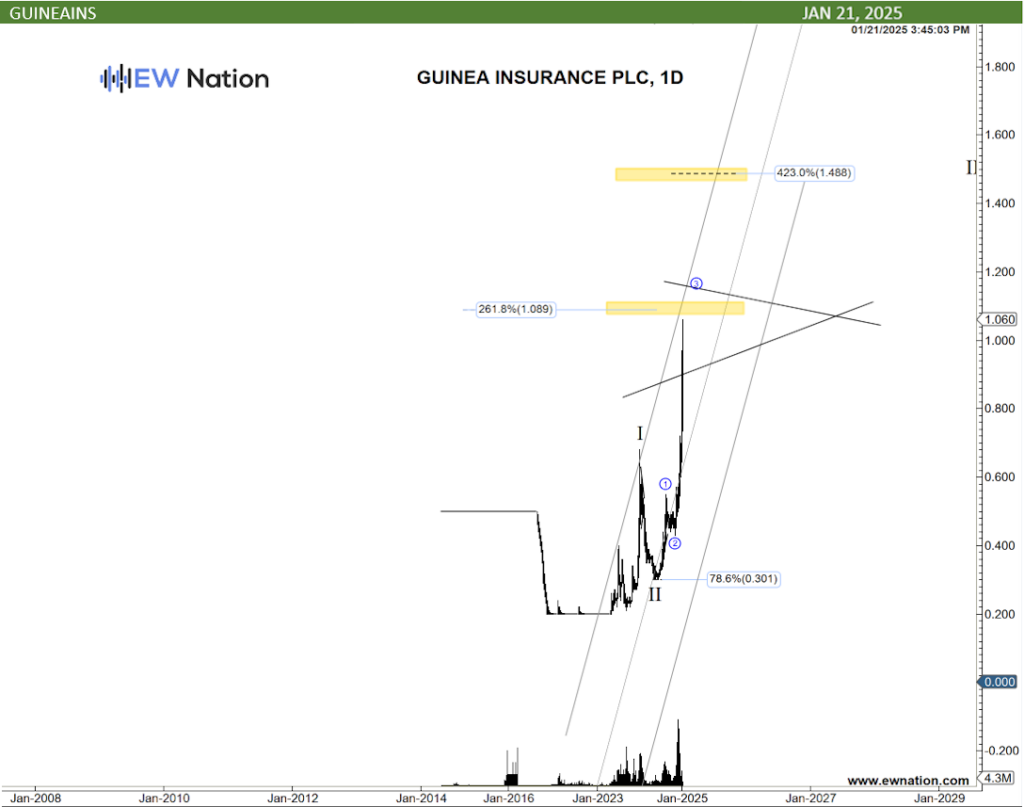

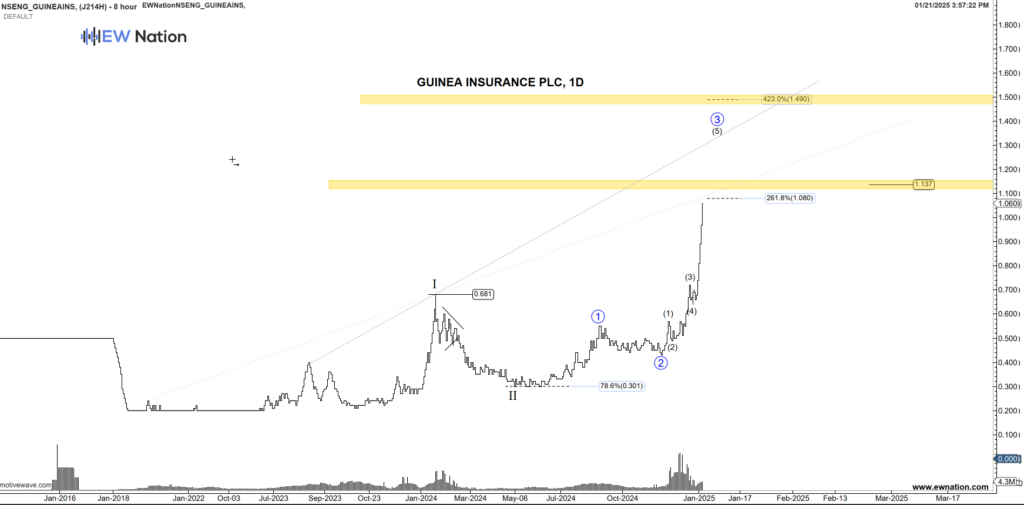

We first spoke about Guinea Insurance Plc (NGX: GUINEAINS) on August 29, 2024 (Guineains Intradays Pattern Points North), highlighting its pivotal role in Nigeria’s insurance sector and its resilience amidst a challenging economic landscape. Over the years, Guinea Insurance has solidified its reputation by offering diverse insurance products tailored to both corporate and individual clients. However, like many players in the Nigerian insurance industry, the company continues to grapple with stock price volatility influenced by macroeconomic and sector-specific factors.

Historically, Guinea Insurance has experienced notable fluctuations in its stock performance. In October 2011, the company’s shares traded at relatively low levels, reflecting broader industry struggles. By August 2016, moderate improvements were observed as sectoral reforms and increased insurance penetration began to yield results. Despite these gains, the stock currently trades at cautionary levels, signaling investor hesitation amidst persistent economic headwinds.

As the Nigerian insurance sector evolves, Guinea Insurance is well-positioned to benefit from ongoing government reforms aimed at improving sector efficiency and increasing penetration. However, investors must remain vigilant, balancing optimism for a potential stock rebound with caution about the company’s ability to navigate operational challenges and economic uncertainties effectively