Dangote Sugar Refinery Plc (NGX: DANGSUGAR) is a major player in the Nigerian sugar industry, known for its substantial contributions to the country’s sugar production and refining capacity. As part of the Dangote Group, a vast conglomerate with interests spanning various sectors, Dangote Sugar has generally benefited from the group’s strong market presence. However, recent developments within the broader Dangote conglomerate, including challenges with the oil refinery project and a Fitch Ratings downgrade, have raised questions about the impact on its individual business units, including Dangote Sugar.

The Impact of Broader Conglomerate Issues

Although Dangote Sugar operates independently from the oil refinery, the challenges faced by the larger Dangote Group can have indirect effects. The Fitch downgrade, for instance, highlights the risks associated with the group’s debt levels, which could potentially impact all subsidiaries, including DANGSUGAR, particularly in terms of financing costs and investor confidence. Moreover, the oil refinery impasse could strain the conglomerate’s financial resources, limiting its ability to invest in other sectors, including sugar.

The recent decline in Dangote Sugar’s stock price may partly reflect these broader concerns. Investors, aware of the interconnected nature of the conglomerate’s various business units, might view the challenges facing the oil refinery project as a sign of potential vulnerabilities within the entire group. As a result, there is growing caution among investors, who might be hesitant to “buy the dip” despite the company’s solid fundamentals in the sugar industry.

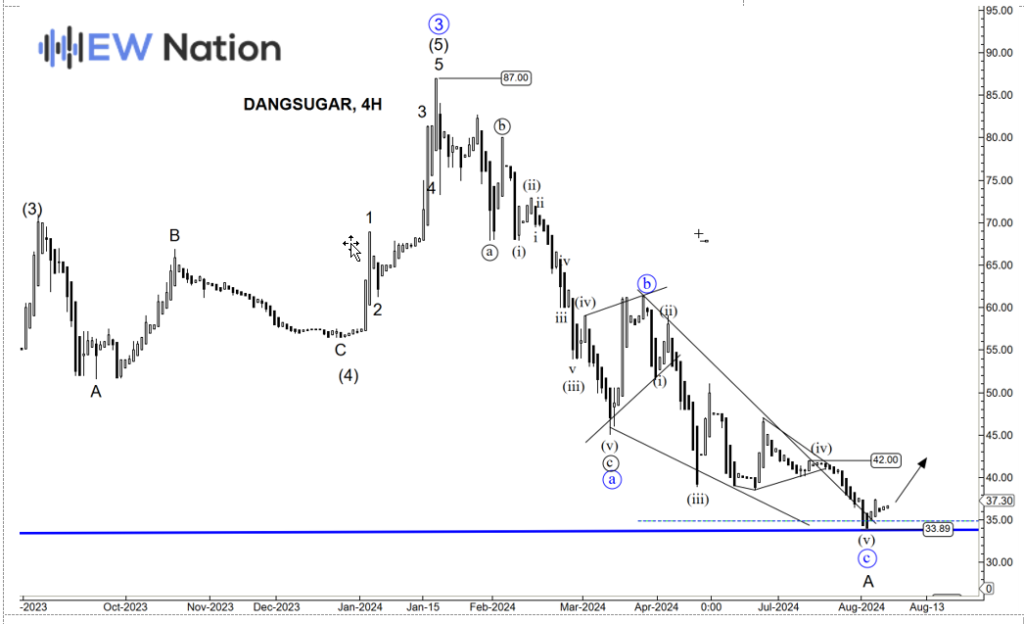

The Elliot Wave chart below suggests that the decline from wave 3 top at 87 in January 2024 has unfolded in a 3 wave move , a classic zigzag pattern A-B-C. If this count is correct, then we expect an impulse which will violate the 42 key level.