The last time we posted about Dangote Sugar was in August 10th, 2024 (Will DangSugar see the light of Day)

In January 2024 the price of DangSugar (NSE:DangSugar) stock was hovering in the vicinity of 80 a share. The company was a stock market darling, whose future looked especially bright considering its last revenue of ₦275 billion, representing a moderate 4% year-over-year growth.

However, rising operational costs, driven by inflation, higher energy prices, and increased logistics expenses, weighed heavily on profitability. The company recorded a significant decline in net income, falling from ₦39 billion in the previous year to ₦23 billion, a stark contrast to its historically strong performance. Gross profit margins dropped to 20%, signaling the pressures from rising input costs and competition in the local sugar market.

The major factor driving the share price decline has been the broader economic environment, with inflationary pressures pushing up the cost of production. The sharp depreciation of the naira has also played a crucial role, increasing the cost of imported raw materials and equipment, which are essential to the company’s refining processes. Furthermore, the company’s total debt increased, reflected in a higher debt-to-equity ratio, making it more vulnerable to market fluctuations and interest rate hikes.

Additionally, regulatory changes in Nigeria’s sugar industry, part of the National Sugar Master Plan (NSMP), which aims to boost local sugar production and reduce imports, have created both opportunities and challenges. While Dangote Sugar has invested heavily in backward integration projects, delays in achieving full-scale production at some of its new facilities have dampened investor sentiment. These challenges, coupled with global supply chain disruptions, have further strained the company’s operational performance.

Despite these challenges, analysts believe that Dangote Sugar’s long-term outlook remains positive. The company’s strategic investments in sugar plantations and refining capacity are expected to yield benefits once global economic conditions stabilize and local production increases. However, in the short term, the company’s share price may continue to face volatility as it navigates these industry challenges and macroeconomic pressures.

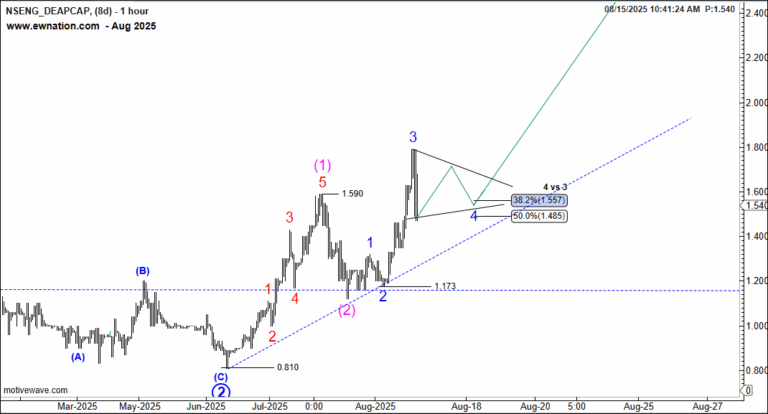

The 1-day chart of DangSugar shows the stocks entire correction for 87 to 34.8 is a wave A correction. As visible, it is a three-wave correction labelled (A)-(B)-(C).

According to the Elliot Wave Principle, impulses pointing the direction of the larger trend, but are followed by a three-wave correction before it resumes. Dangsugar is currently progressing to a larger (B) wave which will take the form of three-waves, a temporary target is the 44 to 52 region. The (a) and (b) waves are easy to recognise as well. The RIS indicator supports the short-term positive outlook with a bullish divergence between (a) and (b).