Financial Analysis: Japaul Gold & Ventures Plc

Japaul Gold & Ventures Plc (JAPAULGOLD) has shown a substantial performance improvement over the past year, driven by a focused business strategy in the energy and mining sectors. In its most recent quarterly report for Q3 2024, Japaul recorded a sharp increase in revenue, reaching NGN 927.68 million, a considerable growth compared to NGN 319.59 million in the same quarter last year. This 190% surge underscores the company’s expansion efforts and growing market position within the Nigerian energy industry.

For the nine months ending September 2024, Japaul reported cumulative revenue of NGN 2.14 billion. This level of revenue, although marginally down from the previous year’s NGN 2.18 billion, reflects the company’s stable position despite macroeconomic challenges, including currency fluctuations and operational cost pressures. The net income for Q3 stood at NGN 174.79 million, a significant year-over-year increase from NGN 74.58 million, highlighting improved profitability from optimized operations and enhanced revenue streams.

Japaul’s success in attracting significant funding from Global Emerging Markets (GEM), a $20 million equity infusion anticipated earlier this year, has also been instrumental in supporting its growth plans. This funding positions the company for future investments in key mining and exploration projects, aiming to enhance its asset base and diversify revenue sources in response to fluctuating market conditions.

Looking forward, Japaul is strategically focused on expanding its core operations in mining, particularly gold, while further optimizing its oil services. The company’s resilience in a challenging economic environment, along with recent financial support, sets a positive trajectory for sustained growth. This forward-looking approach, combined with strategic financial management, makes Japaul an interesting prospect for investors looking to tap into Nigeria’s growing mining sector.

This analysis indicates that Japaul Gold & Ventures is on a promising path, driven by substantial financial backing, strategic expansion, and an upward revenue trend despite the hurdles of Nigeria’s current economic climate.

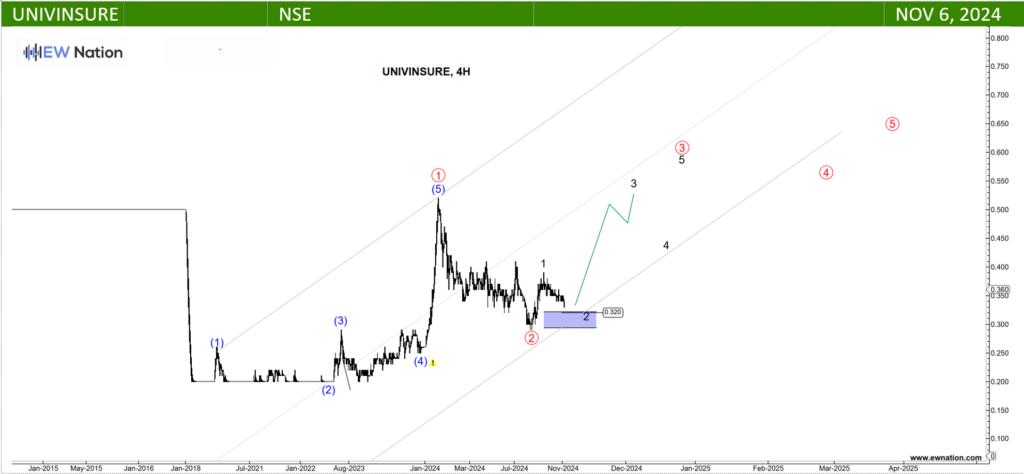

The Elliot Wave chart above shows that JAPAUL is still in a wave 4 correction evidenced by the sideways movement. The sell off from the 3.3 high in a 3 waves decline signifies the Wave A of a potential (A)-(B)-(C) or triangle (A)-(B)-(C)-(D)-(E). We expect further weakness to complete Wave C targeting N1.69 region.