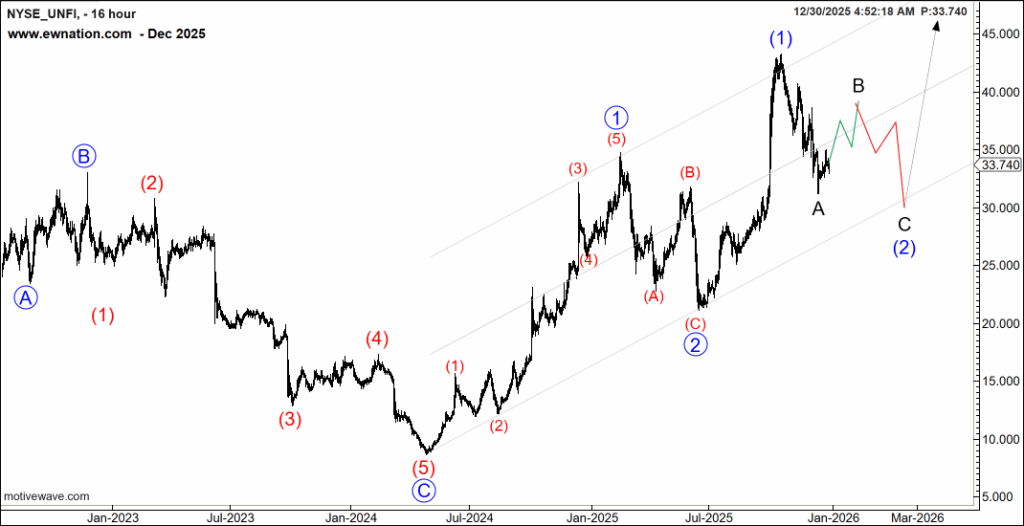

Bottom Line: Lower in three waves to complete wave 2

UNFI shares jumped over 10% on strong investor reaction after management raised guidance for the year — driven notably by an improved free cash flow outlook of roughly ~$200 million, which exceeded prior expectations. Equity moves like this often signal renewed investor confidence in the turnaround story.

UNFI’s recent guidance raise and stronger free cash flow outlook provide a constructive near-term catalyst, and the stock’s positive reaction reflects improved confidence in management execution.

From a valuation standpoint, free cash flow improvement and net leverage reduction are critical to narrowing the discount vs. peers. If UNFI delivers on its multi-year targets, the company could see re-rating from investors.

12/30/2025 8:49EST (Last Price 33.74):

Favouring that wave 2 is yet to complete. Wave three is expected to break the channel to the upside.