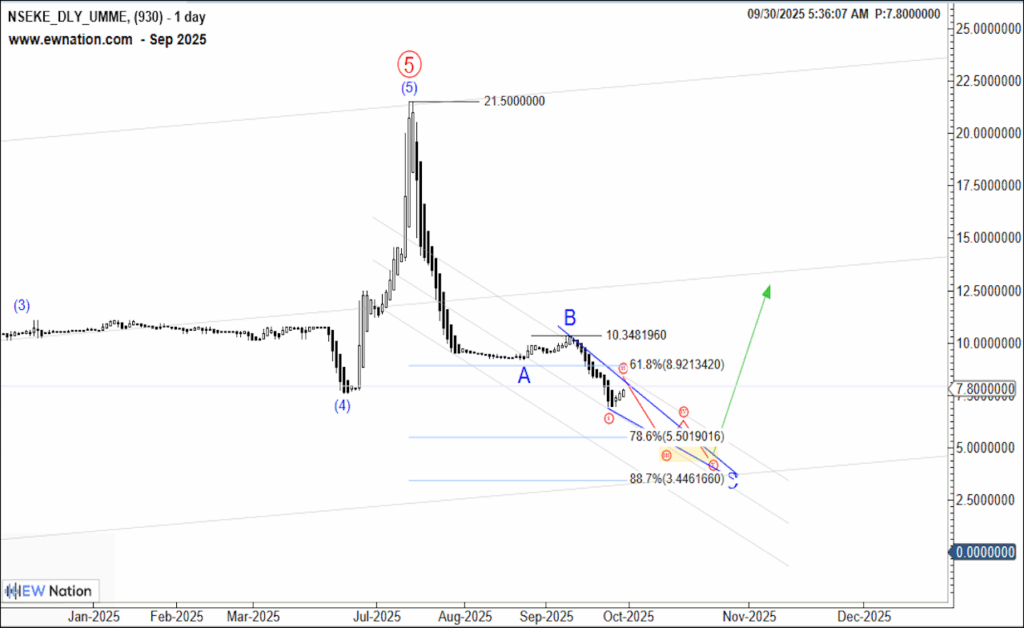

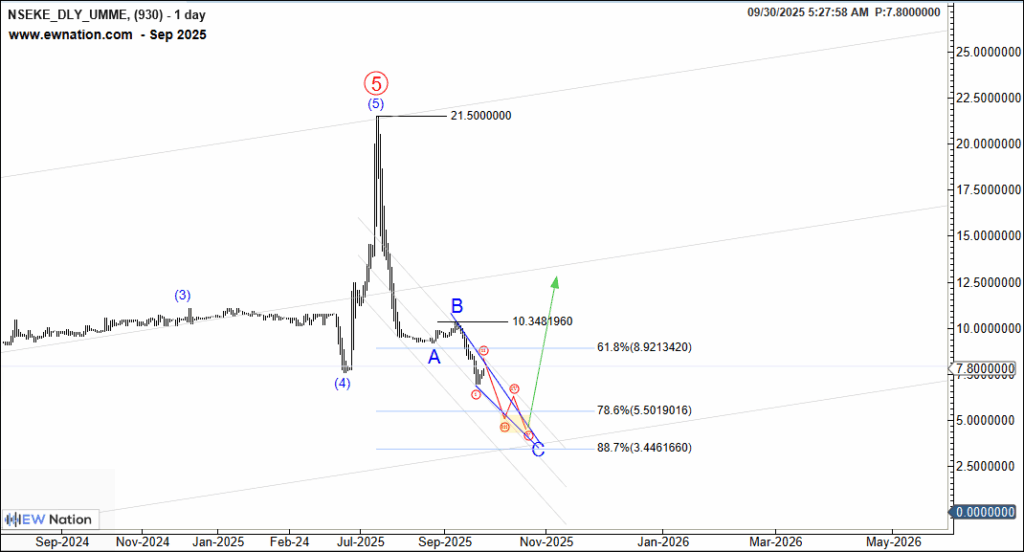

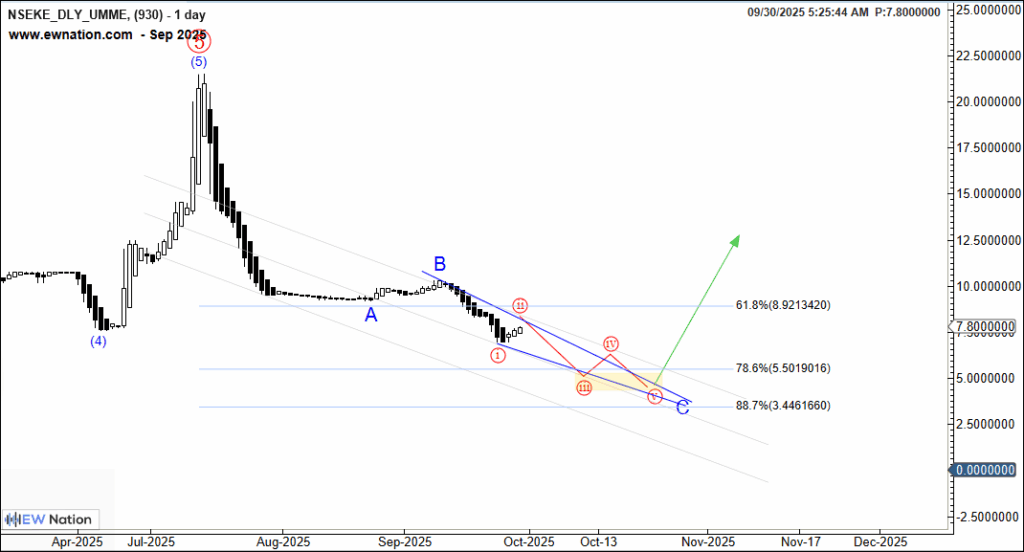

Bottom Line: Lower in three waves to complete wave (ii)

Umeme Ltd. is the primary electricity distributor in Uganda, responsible for operating, maintaining, expanding, and billing distribution networks across many regions.

It holds a long-term concession agreement with the Ugandan government, which gives it regulated rights to distribute power (though this also brings regulatory and political risk).

The company’s revenue model depends heavily on stable electricity demand, collection efficiency, tariff regulation, and investment in distribution infrastructure.

UMME is a high-risk, high-volatility utility play. Its steep decline and poor recent performance mean the downside is well known — the opportunity lies in a shift in regulatory/regime expectations or operational turnaround (especially collection and efficiency). For bulls, waiting for a confirmed base or catalyst may be wiser than jumping in early.

9/30/2025 06:58EST (Last Price 7.8): We are looking for evidence that wave 2 is complete such as a five wave advance above 10.3, however, we keep the door open for further weakness toewards 5 level.