Transnational Corporation of Nigeria Plc (Transcorp) is a diversified conglomerate with strategic investments in the hospitality, power, and energy sectors. Established in 2004, Transcorp has grown into a significant player in Nigeria’s economy.

Financial Performance

In the most recent quarter, Transcorp reported a net income of NGN 11.91 billion, marking a 46.79% increase from the previous quarter’s NGN 8.12 billion. This substantial growth reflects the company’s improved operational efficiency and profitability.

The company’s dividend yield was 1.15% in 2023, with a payout ratio of 24.82%. This indicates a balanced approach to rewarding shareholders while retaining earnings for future investments.

Strategic Business Units

Hospitality: Transcorp Hotels Plc, a subsidiary of Transcorp, owns and operates the Transcorp Hilton Abuja, a premier hotel in Nigeria’s capital. The company has also launched Aura by Transcorp Hotels, a digital hospitality platform, and plans to inaugurate a 5,000-capacity event center in 2024.

Power: Transcorp Power Plc owns the Ughelli Power Plant, a thermal power facility in Delta State with an installed capacity of 1,000 MW. The plant plays a crucial role in Nigeria’s power generation landscape.

Energy: Transcorp Energy Limited operates Oil Prospecting License (OPL) 281, contributing to Nigeria’s oil and gas sector.

Recent Developments

In August 2023, Transcorp led a consortium to acquire a 60% stake in the Abuja Electricity Distribution Company (AEDC), further solidifying its presence in Nigeria’s power sector.

Market Position and Outlook

Transcorp’s diversified portfolio and strategic acquisitions have strengthened its market position. The company’s focus on key sectors such as hospitality and power aligns with Nigeria’s economic development goals. With ongoing projects and expansions, Transcorp is poised for sustained growth, offering value to shareholders and contributing to national development.

Conclusion

Transnational Corporation of Nigeria Plc continues to demonstrate robust financial performance and strategic foresight. Its diversified investments and recent acquisitions underscore its commitment to driving economic growth and delivering value to stakeholders.

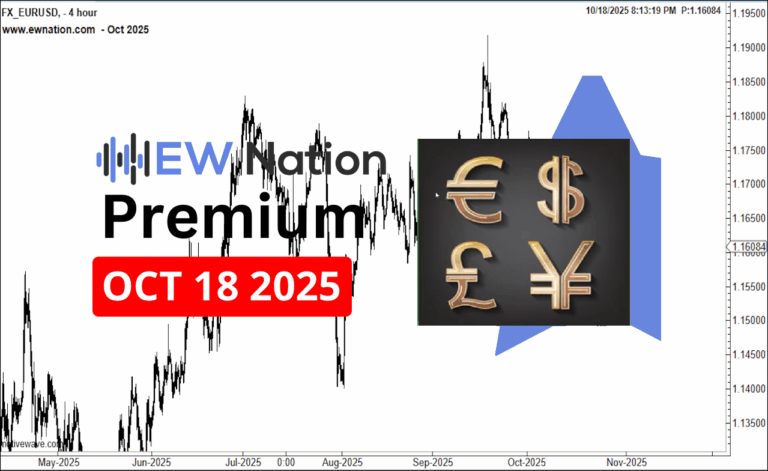

From the Elliot Wave above, Transcorp is making series of nested wave 1. The 23% sell off which unfolded in 7 days from 61.95 high to 47 can be seen as a wave A, which can be part of a triangle, flat or zigzag correction. We favor an ABC zigzag to complete Wave 2 of the impulse.

If this count is correct, then we expect this asset to remain above the blue line as it impulse move unfolds.