Tesla Inc., the global leader in electric vehicles and renewable energy solutions, has long been a key player in transforming the automotive and energy industries. While the company has experienced impressive revenue growth and expansion in recent years, its share price has faced significant volatility. Sentiment surrounding Tesla has been largely bearish for much of the past year, as concerns over valuation, supply chain disruptions, and increased competition weighed on the stock. However, recent financial performance and positive operational updates are leading analysts to reconsider Tesla’s long-term prospects.

In its most recent quarterly report, Tesla posted revenues of $25.9 billion, reflecting a strong year-over-year growth of 47%. This growth was primarily driven by increased deliveries of its Model 3 and Model Y vehicles, as well as its energy generation and storage businesses. However, net income saw a slight decline, falling to $2.3 billion, down 9% compared to the previous year. The drop in profitability is attributed to rising raw material costs, supply chain disruptions, and price cuts aimed at maintaining market share amid growing competition.

A key financial metric that has captured the attention of analysts is Tesla’s free cash flow, which declined to $847 million from $3.3 billion in the prior quarter. This decline was due to increased capital expenditures as the company continues to ramp up production at its Gigafactories in Texas, Berlin, and Shanghai. Despite this, Tesla maintains a strong cash position, with over $25 billion in cash and cash equivalents, providing it with the financial flexibility to continue expanding.

Tesla’s gross margin also fell to 18.2%, down from 26.5% in the same period last year, as the company grapples with cost pressures and competitive pricing strategies. Despite these challenges, analysts are beginning to shift their outlook on Tesla, with many citing the company’s advancements in full self-driving technology and its growing energy storage business as potential future growth drivers.

Looking ahead, Tesla’s long-term prospects remain tied to its ability to scale production and maintain its leadership in the electric vehicle space while navigating rising competition and macroeconomic pressures. While bearish sentiment has dominated in recent quarters, analysts are increasingly optimistic about the company’s ability to leverage its innovative edge and global production capacity, positioning it for a potential rally in the near future.

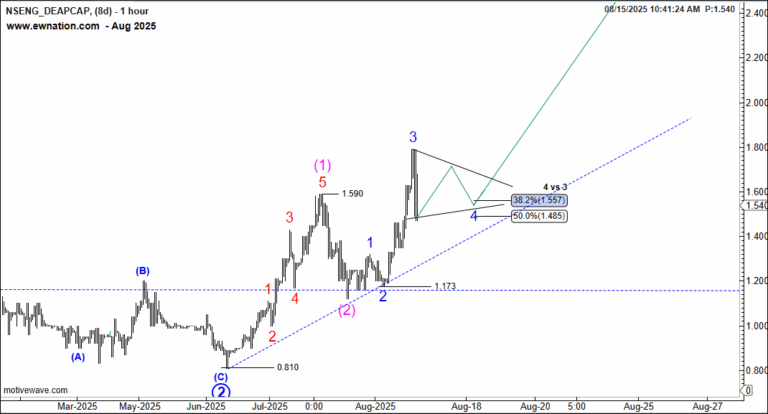

The Elliot Wave charts shows that Tesla is about to commence an impulse to the upside. The 1-2 1-2 nested Elliot Wave pattern displayed above suggests that a significant impulsive move may follow.

If this count is correct then we may see further weakness to complete the wave 2 towards 180 region.