Tantalizers Plc (Ticker: TANTALIZER) Positioned for Recovery After Extended Downturn

Tantalizers Plc (TANTALIZER), a well-known fast-food chain in Nigeria, has struggled with prolonged underperformance due to economic challenges, rising operational costs, and stiff competition in the quick-service restaurant (QSR) sector. The company’s stock has fallen by over 50% from its previous highs, as investors have expressed concerns about its ability to regain profitability in a highly competitive market. Despite these setbacks, Tantalizers remains a key player in Nigeria’s fast-food industry, offering a range of popular menu items catering to a broad consumer base.

In its most recent financial reports, Tantalizers recorded revenue of ₦1.7 billion, a modest 6% increase year-over-year. The company’s focus on cost-cutting measures and streamlining operations has helped stabilize its financials, but profitability remains elusive, with a net loss of ₦210 million for the year. While this is an improvement from the ₦320 million loss in the previous year, the company is still struggling to navigate rising costs for raw materials and overhead, particularly in light of Nigeria’s inflationary pressures.

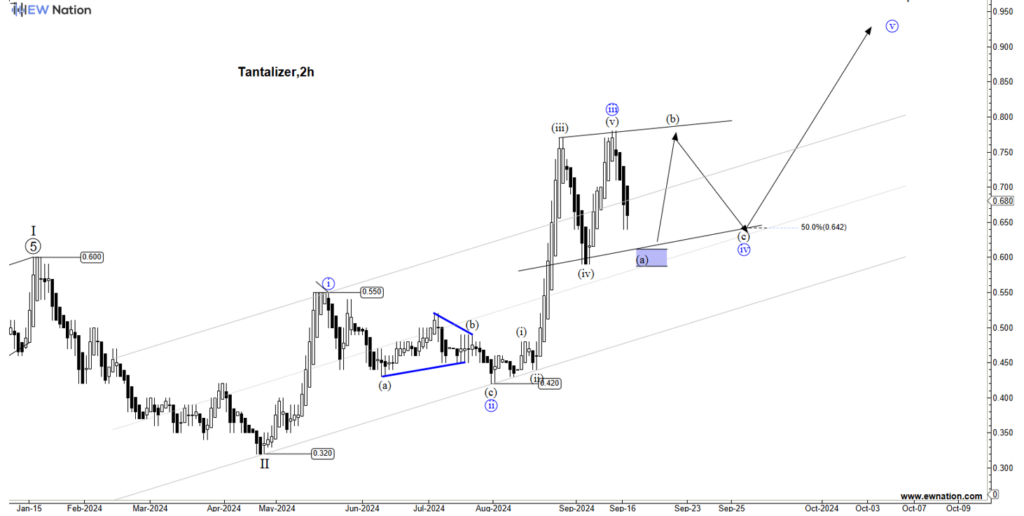

Currently trading at a price-to-sales (P/S) ratio of 0.4, Tantalizers’ stock is considered significantly undervalued compared to its industry peers. Analysts believe the company may be entering a recovery phase, as technical indicators suggest the stock is bottoming out after an extended downturn. Some market observers using Elliott Wave Theory point to a potential short-term rally, driven by Tantalizers’ renewed efforts to revamp its menu, expand franchise operations, and improve its overall customer experience.

However, risks remain for Tantalizers as it continues to operate in a challenging economic environment. Rising input costs and intense competition from both local and international QSR brands could hamper its recovery efforts. Nonetheless, the company’s strategic focus on operational efficiency and expansion plans provides a foundation for long-term growth. Investors looking for potential recovery plays in Nigeria’s QSR market may find Tantalizers’ current stock price an attractive entry point, particularly as the company looks to emerge from its financial struggles.

The Elliot Wave chart above shows that the TANTALIZER has completed wave 1 of an impulse labeled (1)-(2)-(3)-(4)-(5) (circle labels). The move from 0.320 low suggests that another impulsive move is on the way.

If this count is correct, then TANTALIZERS will progress towards wave 5 (blue) with a short term target of 1..