Royalex Inc. has had a standout year, with its stock up nearly 30% in 2024, significantly outperforming the broader market. However, even with these gains, the stock still trails its all-time highs from 2021, and the company’s fundamentals may not fully justify the recent price surge.

A closer examination of Royalex’s financials reveals a company facing a challenging growth environment. Over the past few years, revenue and free cash flow have grown only modestly, and profitability remains under pressure from rising operational costs. Despite these hurdles, Royalex management projects slight gains in Q4 revenue, though Gross Merchandise Volume (GMV) is expected to be relatively flat. This cautious guidance reflects both market competition and a need for more transformative growth initiatives.

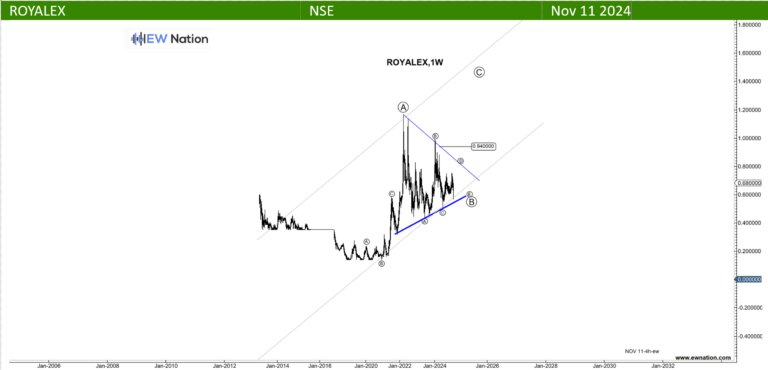

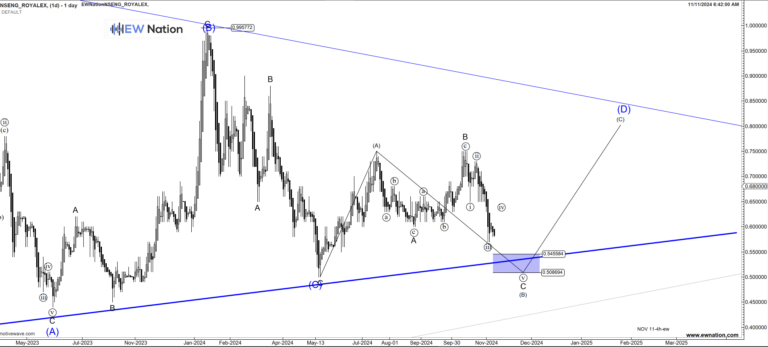

Given the limited organic growth potential, Royalex’s recent stock price increase appears to hinge on multiple expansion, where the stock’s valuation rises not due to earnings growth but because of investor willingness to pay more per share. Sustaining this sentiment-driven rally, however, is not guaranteed. Technical analysis, including Elliott Wave projections, hints at a potential cooling off in Royalex’s stock price heading into the new year.

In summary, while Royalex has had a strong year, its underlying business fundamentals may not fully support the stock’s recent momentum. Investors eyeing Royalex may want to proceed with caution, watching for strategic pivots or improvements in revenue growth as potential indicators for long-term sustainability.

The Elliot Wave chart above shows that ROYALEX is in a sideways correction and setting up for Wave D of the correction. The correction which is printed as a form of triangle has seen completion of Waves (A)-(B)-(C) with (D)-(E) yet to be printed.

We expect a temporary reversal around the 0.55 region for the completion of Wave D around 0.8 region.