PRA Group, Inc. (NASDAQ:PRAA), headquartered in Norfolk, Virginia, is a global leader in acquiring and collecting nonperforming loans (NPLs), founded in 1996 as Portfolio Recovery Associates. Operating in the Americas, Europe, and Australia, the company purchases delinquent consumer debts (e.g., credit card, auto, and consumer loans) at a discount and pursues collection of the full amount owed. PRA Group reported a record estimated remaining collections (ERC) of $7.8 billion in Q1 2025, with total portfolio purchases up 18.7% to $291.7 million.

Its P/E ratio of 10.6x is within the U.S. Consumer Finance range (10–15x) but below the Nasdaq average (~25x), suggesting undervaluation.

We examined this asset in light of Elliot wave principle and this is what we found.

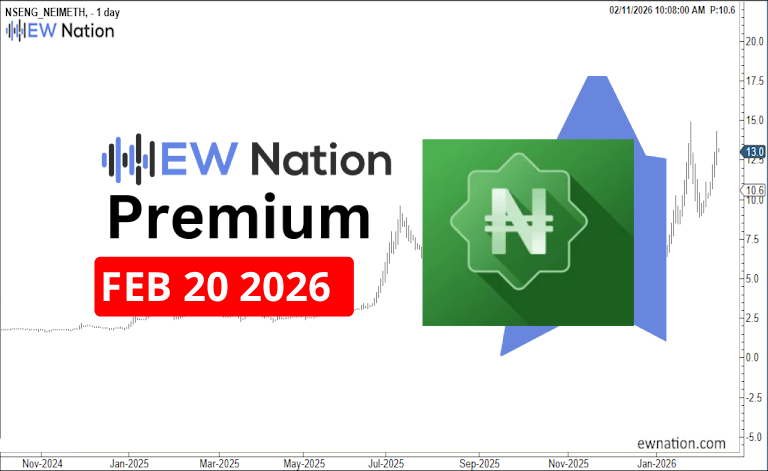

The Chart above suggests that PRAA is yet to complete Wave 5. of C which will effectively complete wave 2. The 4 H chart shows that PRAA may have completed Wave 1 to the downside and is headed for wave 2. We expect Wave 2 to complete somewhere around the 61.8 Fibonacci ratio of wave 1 which is the $20 region.

If this count is correct, then PRAA will continue downwards upon completing wave 2.

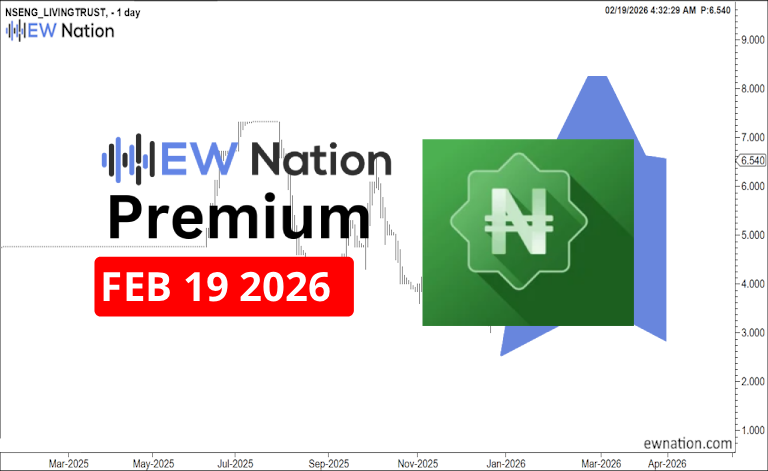

The Chart below highlights an alternative to the setup above which is still a valid Ellit wave chart. The chart suggests that wave 2 is in and therefore we should be looking higher for wave 3. If this is the case, then we will have a significant push which will challenge the wave 4 position.

In our Elliot Wave Premium subscriptions we provide analyses of Stocks, Cryptocurrencies and forex. Check them out now!