Omatek Ventures Plc, a Nigerian computer hardware manufacturer, has faced financial hurdles recently but is actively pursuing strategies to bolster its capital structure.

Financial Performance

In the fiscal year ending December 31, 2024, Omatek reported a revenue of ₦6.27 million, a significant increase from ₦0.10 million in 2023. Despite this growth, the company recorded a net loss of ₦62.14 million, deepening from a ₦4.10 million loss the previous year. Administrative expenses rose to ₦68.41 million, up from ₦64.01 million in 2023. Notably, the company did not report any other income in 2024, unlike the ₦35 million recorded in 2023.

For the half-year ending June 30, 2024, Omatek’s revenue was ₦0.9 million, compared to ₦0.1 million in the same period the previous year. The net loss for this period was ₦10.35 million, a significant improvement from the ₦441.98 million loss reported in 2023.

Capital Raising Initiatives

To strengthen its financial position, Omatek’s directors received approval to raise capital by allotting 4,058,210,528 unissued ordinary shares. This move aims to enhance the company’s capital base through methods such as rights issues, public offers, private placements, or debt-to-equity conversions.

Conclusion

While Omatek Ventures Plc has experienced financial setbacks, its proactive approach to capital raising reflects a commitment to revitalizing operations and achieving financial stability.

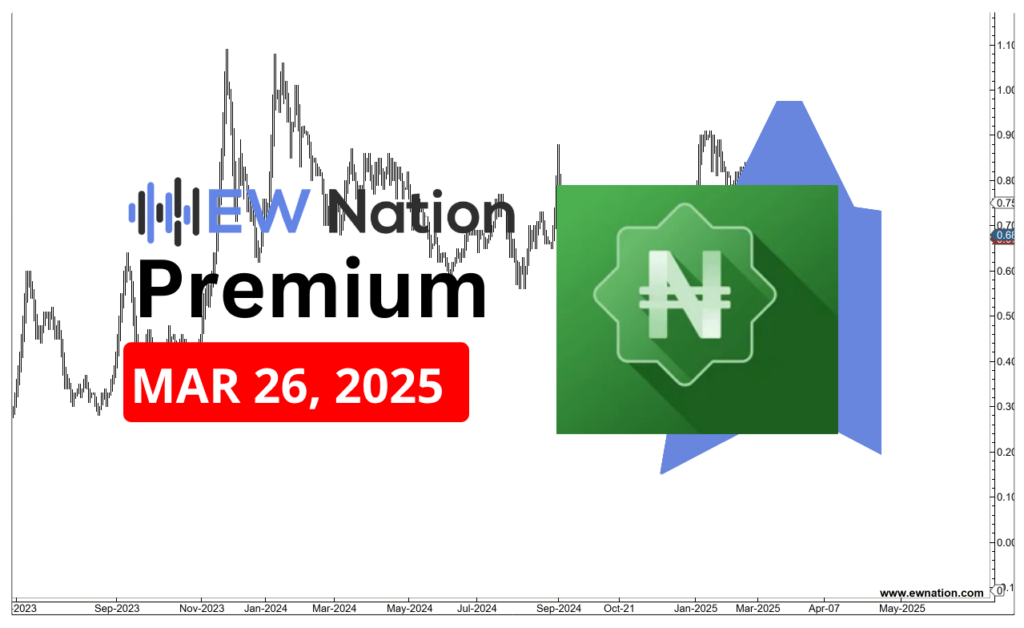

From the Elliot Wave above, Omatek has printed a wave 1 and 2. The current move is a wave C of sub wave 1. The pattern is unfolding as a w-x-y, if this wave count is correct then two things need to happen (1) price cannot go below 0.56 low which is wave 2 and (2) a rally to the upside should commence to herald the sub wave 3.