We first blogged about Secure Electronic Technology Plc (NSLTECH) on [NSLTECH – can it keep up], and since then, the company has continued to navigate a challenging operating environment while showing glimpses of potential. NSLTECH remains a prominent player in Nigeria’s electronic technology and security solutions sector, but its financial performance reflects both opportunities and ongoing pressures.

As of early 2025, NSLTECH’s stock price has held steady at ₦0.56, maintaining a year-over-year growth of 107.41%. This increase signals strong investor confidence despite persistent challenges in profitability. The company’s annual revenue rose by 30.3%, showcasing expansion in its core operations, yet net income for the most recent quarter declined to ₦-45.88 million, a drop from ₦-28.15 million in the prior quarter. The company’s negative EBITDA margin of -4.42% remains a concern, highlighting inefficiencies in its operations.

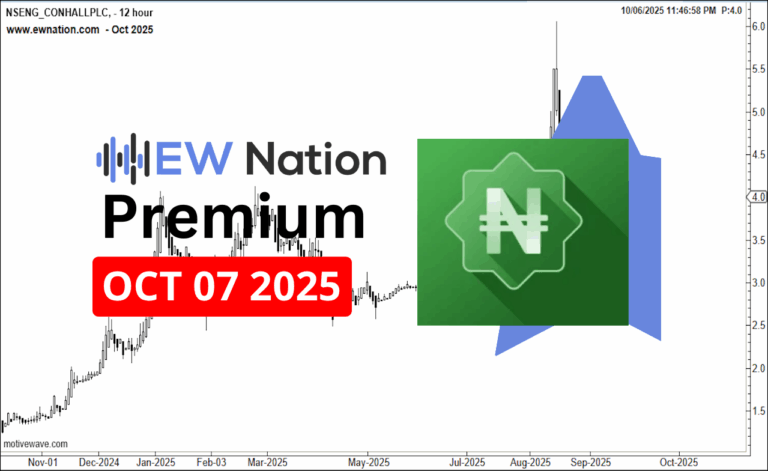

From a technical perspective, NSLTECH’s stock has been volatile. The share price peaked at ₦0.96 in early 2025 but has since undergone a correction. Current support stands at ₦0.68, indicating a tight trading range. Analysts suggest that a break above or below these levels could determine the next significant movement. Technical indicators, such as the Elliott Wave Chart, point to an unfolding double zigzag pattern, suggesting a potential near-term upswing with a possible A-wave to the upside.

Despite these challenges, NSLTECH is well-positioned to capitalize on Nigeria’s growing demand for electronic and security technology solutions. Strategic partnerships and improvements in operational efficiency could help the company address its profitability issues and build long-term resilience. Investors should weigh the company’s promising growth trajectory against its financial risks, focusing on potential catalysts like cost optimization and diversification to unlock sustained market confidence.

From the Elliot wave chart above, NSLTECH’s sell off is in formation of a wave C of A. The move from 0.52 unfolded in 5 waves, this is either a Wave A or wave 1 signifying that there is more impulse to the upside.

If this count is correct, then we expect a reversal around 0.687.