Secure Electronic Technology Plc (NSLTECH), listed on the Nigerian Exchange under the ticker “NSLTECH,” is a notable player in Nigeria’s electronic technology and security solutions sector. Despite recent challenges, the company has shown resilience with promising signs in specific performance metrics.

Recent Performance

As of late 2024, NSLTECH’s stock price stands at ₦0.56, with a market capitalization of approximately ₦3.15 billion. Year-over-year, the company has demonstrated a 107.41% growth in stock value, indicating strong investor interest despite broader market volatility. However, NSLTECH’s earnings per share (EPS) are currently negative at ₦-0.023, reflecting underlying profitability challenges.

The company’s annual revenue increased by 30.3%, showcasing growth in its operational segments. However, the recent quarterly net income declined to ₦-45.88 million, compared to ₦-28.15 million in the previous quarter. This highlights continued pressure from operational inefficiencies and costs

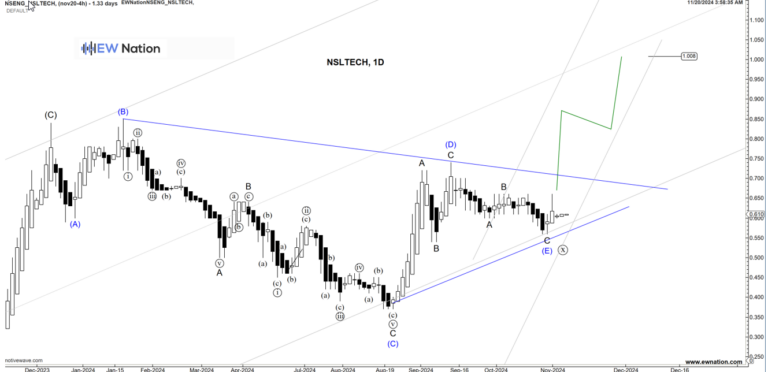

Technical Analysis

NSLTECH’s stock performance over the past year has shown significant volatility. The stock reached an all-time high of ₦0.85 in early 2024 but has since corrected. Moving averages suggest a mixed outlook, with a neutral to sell rating on short-term indicators, while the one-month technical rating signals a potential buy opportunity, suggesting optimism for a near-term recovery.

Key resistance levels are noted at ₦0.60, with immediate support at ₦0.50. Breaching either of these levels could determine the stock’s short-term trajectory. Investors should monitor the stock’s trading volume and external factors influencing Nigeria’s tech and security markets.

Challenges and Opportunities

NSLTECH faces ongoing challenges, including:

- A negative EBITDA margin of -4.42%, indicating inefficiencies in core operations.

- Currency devaluation pressures, which increase costs for imported technology components.

On the opportunity front:

- Expanding demand for electronic and security technology solutions in Nigeria positions NSLTECH for long-term growth.

- Strategic partnerships or operational improvements could help address its profitability concerns.

Outlook

While Secure Electronic Technology Plc has made strides in revenue growth, its financial health remains under strain, as reflected in its negative EPS and EBITDA. Investors should approach cautiously, balancing the company’s growth potential against its operational risks. A focus on cost optimization and strategic diversification could provide the catalyst NSLTECH needs to achieve sustained profitability and market confidence.

NSLTECH’s Elliot Wave Chart is unfolding as a double zigzag, this is usually a well contained movement of multiple advances and declines between two parrallel lines. With 3 waves moves already printed as A-B-C and an adjoining X wave in play, we now expect that the following move will be an A wave to the upside.

Can it keep up, we think the near future opportunity exists for this asset.