We first analyzed Neimeth International Pharmaceuticals Plc on October 11, 2024 (Neimeth – Eliot Wave Correction underway), highlighting the company’s position as a leader in Nigeria’s pharmaceutical industry amidst economic challenges. As of the most recent reports, Neimeth has significantly improved its performance, showcasing resilience and a strong recovery trajectory.

Financial Performance Highlights Neimeth’s revenue for the nine months ended September 30, 2024, surged by 105% to ₦3.09 billion, doubling from ₦1.51 billion in the same period in 2023. This growth was largely driven by robust pharmaceutical sales, which accounted for 96.5% of the total revenue, complemented by contributions from animal health products. Gross profit jumped by 149% to ₦1.45 billion, reflecting a gross margin improvement from 38.6% in 2023 to 46.9% in 2024.

The company also reversed its bottom line, achieving an operating profit of ₦310.49 million in 2024 compared to a loss of ₦575.27 million the previous year. Operating profit margins increased to 10.02%, marking a substantial recovery from -38.06% in 2023. Earnings per share turned positive at 7 kobo, up from a loss of 13 kobo.

Strategic Developments Neimeth’s ongoing upgrades to its Lagos production facility have expanded its manufacturing capacity, allowing the company to meet rising demand for local pharmaceuticals. This investment aligns with Nigeria’s push for increased local production of essential medications. Managing Director Valentine Okelu highlighted the company’s focus on innovation, cost management, and market share expansion as key drivers of its improved performance.

Technical Analysis From a stock market perspective, Neimeth has shown a gradual recovery in investor confidence, evidenced by an increase in its return on equity from -38.9% in 2023 to 17.4% in 2024. This suggests that strategic improvements are translating into tangible gains for shareholders. However, market volatility and sector-specific risks persist, requiring careful monitoring of future performance.

Outlook Neimeth’s strategic initiatives and growing operational efficiency position it well for continued growth, though rising inflation and currency depreciation remain challenges. Investors will be keenly watching the company’s ability to sustain its profitability and drive further innovation in Nigeria’s expanding pharmaceutical market.

The company’s resilience and recent recovery indicate a promising trajectory, making it a stock to watch in the healthcare sector.

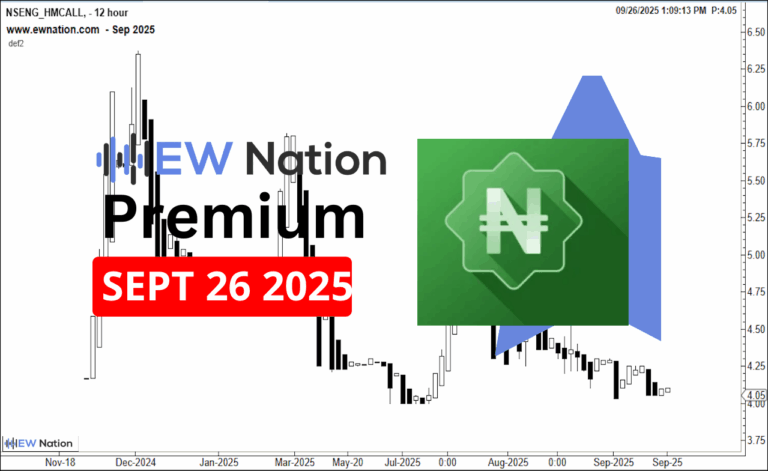

The Elliot Wave Chart above shows that Neimeth has printed a triangle (A)-(B)-(C)-(D)-(E) in the x wave position. According to the Elliot Wave theory, a triangle precedes a final move to the upside, we therefore expect to see a further move to the upside. With Wave 1 is an impluse already printed, the next move should see Neimeth challenge the wave 1 top at 2.3 NGN and above.