Neimeth International Pharmaceuticals Plc, a prominent name in Nigeria’s pharmaceutical industry, has shown resilience and adaptability amid fluctuating economic conditions and supply chain disruptions. Known for its essential medications targeting diseases like hypertension, diabetes, and other common ailments, Neimeth is well-positioned to benefit from the growing demand for healthcare products in Nigeria. However, the company is currently navigating various operational challenges, including rising costs, supply chain difficulties, and inflationary pressures.

In its latest financial results, Neimeth reported revenue of ₦3.8 billion, reflecting a modest year-over-year growth of 6%. This growth was mainly driven by increased demand for its over-the-counter and ethical pharmaceuticals. However, despite this revenue increase, the company’s net profit fell to ₦320 million from ₦500 million in the previous year, as it grappled with higher raw material and production costs, a common issue for local manufacturers amid Nigeria’s economic volatility.

Neimeth’s cost-to-income ratio stands at approximately 80%, indicating the strain of managing operational expenses in the current market environment. Rising inflation, foreign exchange fluctuations, and increased procurement costs have weighed heavily on the company’s margins. Despite this, Neimeth’s balance sheet remains relatively stable, with a debt-to-equity ratio of 0.5, which provides the company with some flexibility to manage debt and continue investing in growth initiatives.

A critical aspect of Neimeth’s strategy is its focus on expanding its manufacturing capacity to meet the increasing demand for locally produced pharmaceuticals. The company is in the process of upgrading its production facilities to improve efficiency and output. These efforts are expected to enhance its market share as the Nigerian healthcare system continues to prioritize the local production of essential medications.

Looking ahead, analysts remain cautiously optimistic about Neimeth’s long-term prospects, citing its strong presence in Nigeria’s healthcare market and its ongoing investment in production expansion. However, the near-term outlook remains uncertain as the company deals with cost pressures and a challenging economic environment. Investors will be closely monitoring how Neimeth balances cost management with its strategic growth initiatives to maintain profitability in the future.

In conclusion, while Neimeth faces short-term challenges related to rising costs and economic headwinds, its strong market position and commitment to expanding its production capabilities provide a solid foundation for future growth. The company’s ability to manage its operational expenses while continuing to capitalize on rising demand for healthcare products will be key to its long-term success in Nigeria’s evolving pharmaceutical sector.

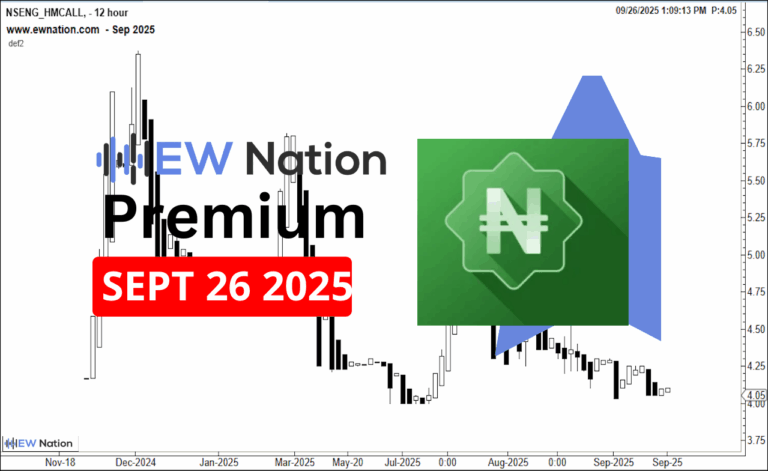

The Elliot Wave chart below shows that Neimeth has completed wave 4 and making progress towards wave 5. The unfolding correction is in 3 waves and is a subwave 2 with a target around the 1.77 region before the uptrend will resume again.