In our last post in September 2024, we highlighted NASCON Allied Industries (NASCON) facing a challenging period after its stock price suffered a 60% correction. This correction came amidst Nigeria’s tough economic environment, driven by inflation and supply chain disruptions. However, recent signs suggest a potential recovery may be on the horizon for the company, as market sentiment begins to shift.

For 2023, NASCON reported ₦45 billion in revenue, showcasing resilience through rising demand for its core products, including salt, seasonings, and vegetable oil. The company’s net income stood at ₦7.3 billion, despite cost pressures. NASCON’s stock is now trading at a P/E ratio of 5.8, which could signal an undervaluation given its solid financial performance and strong market position within Nigeria’s fast-moving consumer goods (FMCG) sector.

Technically, the stock appears to have found support following its sharp sell-off, and analysts are starting to forecast a bullish reversal. With oversold conditions and NASCON’s fundamentals intact, the stock might see a rally in the near term. The company’s ongoing strategic initiatives to manage costs and expand its product lines position it well for growth as economic conditions improve.

Investors eyeing opportunities in Nigeria’s FMCG sector may find NASCON appealing, as it looks set for a recovery, backed by a solid operational foundation and improving market conditions.

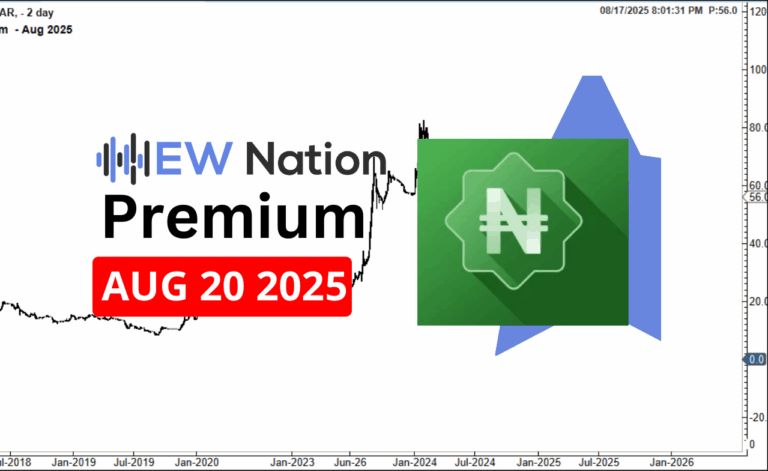

The Elliot Wave chart below suggests that a bottom may be in for NASCON in this present correction cycle. We have seen a sell off in 3 waves to the bottom at (c)29.49. Upon which an impulse unfolded as an A wave and then a 3 wave decline to 30 setting the stage for a wave C.

If the count is correct, then we should be hitting a target in the 49 region which is the 161.8% of (a).