MTN Nigeria (MTNN), a major subsidiary of MTN Group, continues to perform robustly amidst economic challenges. In its 2023 financial year, the company posted a strong 21.5% growth in service revenue, primarily driven by data and fintech services. Data revenue surged by 48%, reflecting an increased focus on expanding active data users and traffic. Despite a 19.4% decline in fintech revenue, MTNN maintained an impressive EBITDA margin of 53.2%, up by 0.2 percentage points from the previous year.

MTNN has faced headwinds, including the depreciation of the Naira and rising operational costs, especially in energy. However, the company managed to maintain solid financial performance by unlocking operational efficiencies. Capital expenditures for 2023 reached ₦13.7 billion, reflecting their commitment to network expansion, while digital and enterprise business segments posted notable growth.

Looking forward, MTNN remains well-positioned to benefit from Nigeria’s expanding mobile and data market, even as it navigates macroeconomic challenges. Recent strategic initiatives, like the partnership with Mastercard for its fintech business, further position MTNN for long-term growth in digital payments and e-commerce

.

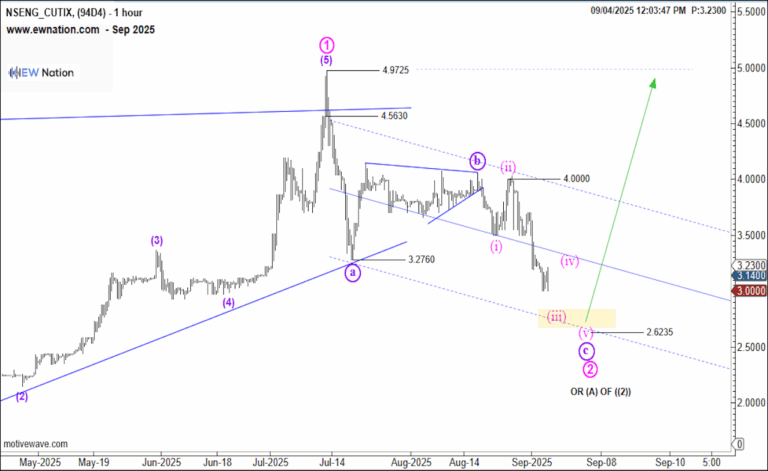

The chart above shows that MTNN has completed wave 1 in Q1 24. The unfolding structure is a correction for the Wave 2, and has unfolded as a three way structure (A)-(B)-(C).

The C wave subdivided ino 3 waves each (a)-(b)-(c) suggesting that the move is an ending diagonal.

If the count is correct then MTNN should hit a wave c target between 155 and 168 before the impulse resumes.