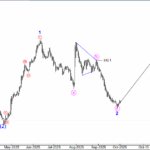

The Elliot Wave Chart below shows that DangSugar has hit a strong support at 30 region. Having just completed a steep correction to the downside labelled A-B-C signifying wave A, We expect that DangSugar will retrace some or all of Wave A.

Categories

Forex

+-

-

Sep 24, 2025 Premium

Sep 24, 2025 Premium -

Sep 16, 2025 Premium

Sep 16, 2025 Premium

Crypto

+-

Oct 29, 2025 Premium

Oct 29, 2025 Premium -

Oct 27, 2025 Premium

Oct 27, 2025 Premium -

Oct 16, 2025 Premium

Oct 16, 2025 Premium

US Stock

+-

Oct 27, 2025

Oct 27, 2025 -

Oct 3, 2025 Premium

Oct 3, 2025 Premium -

Oct 3, 2025

Oct 3, 2025

NGX Stock

−-

Nov 12, 2025 Premium

Nov 12, 2025 Premium -

Nov 12, 2025 Premium

Nov 12, 2025 Premium -

Nov 7, 2025 Premium

Nov 7, 2025 Premium

Gold and Silver

+-

Oct 20, 2025 Premium

Oct 20, 2025 Premium -

Sep 6, 2025 Premium

Sep 6, 2025 Premium -

Jul 7, 2025

Jul 7, 2025

Crude Oil

+-

Sep 6, 2025 Premium

Sep 6, 2025 Premium -

Aug 6, 2024

Aug 6, 2024

You May

Also

Like

Oando November 12th, 2025 Update...

JapaulGold November 7th, 2025 Update...

JapaulGold November 7th, 2025 Update...

UCAP November 7th, 2025 Update...

Accesscorp November 7th, 2025 Update...

Sovrenins November 7th, 2025 Update...

Learn More about Elliot Wave Theory

Our Clients Reviews

Read what our clients have to say about their experience with EWNation.