McNichols Consolidated Plc: Strong Financial Growth and Expansion Strategy

McNichols Consolidated Plc, a prominent player in Nigeria’s food and beverage industry, has exhibited noteworthy financial growth and strategic initiatives in recent months, underscoring its commitment to expansion and enhanced market presence.

Financial Performance

In 2024, McNichols reported a substantial increase in revenue, reaching ₦5.86 billion—a 267.26% rise from the previous year’s ₦1.59 billion. Earnings also saw a significant uptick, totaling ₦116.06 million, marking a 221.80% increase compared to the prior year. These figures reflect the company’s robust operational efficiency and growing market demand for its diverse product offerings.

Capital Raising Initiatives

To fuel its expansion plans, McNichols initiated a rights issue in August 2023, aiming to raise approximately ₦265.62 million. The company offered around 531.243 million ordinary shares to existing shareholders at a unit price of 50 kobo, on the basis of 17 new shares for every 23 shares held as of September 16, 2022. The proceeds from this initiative were earmarked for several strategic purposes, including:

- Acquisition of a new cube sugar plant.

- Procurement of packaging equipment to meet growing customer demands.

- Purchase of distribution vehicles.

- Expansion of depots and operating locations.

- Enhancement of working capital to drive sales and profitability.

Strategic Focus and Market Position

McNichols has strategically positioned itself to cater to Nigeria’s burgeoning mass market for food and beverage products. The company’s diverse product portfolio includes custard products, pancake mixes, sugar, chocolate-flavored milk, tea, and various milk-based products. These offerings are distributed through a robust network of reputable distributors across the country.

Chairman Olusegun Layode emphasized the company’s focus on leveraging Nigeria’s growing youthful population, which constitutes more than half of the nation’s inhabitants. He highlighted strategies such as aggressive advertising, expansion of brand and product lines, and increasing market share by meeting rising consumer demands.

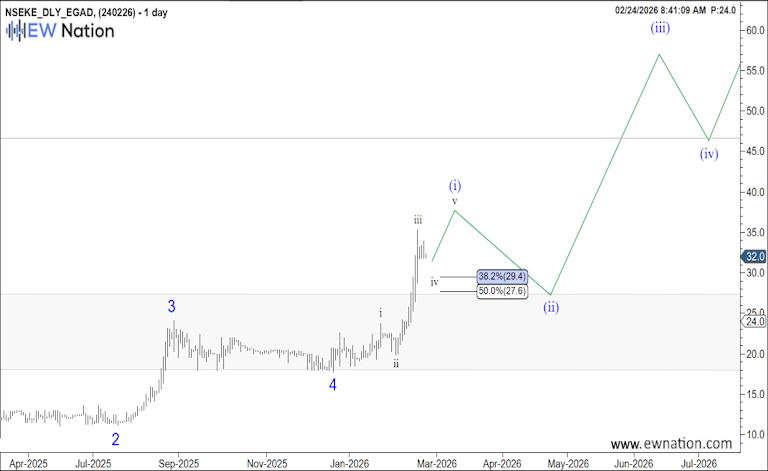

Market Performance

As of February 27, 2025, McNichols’ stock price stood at ₦1.75 per share, reflecting a 2.94% increase from the previous close. The company’s market capitalization was approximately ₦1.95 billion, with a price-to-earnings (PE) ratio of 16.56. Additionally, McNichols declared a dividend of ₦0.02 per share, yielding 1.14%, with an ex-dividend date of November 4, 2024.

Conclusion

McNichols Consolidated Plc’s recent financial performance and strategic initiatives underscore its dedication to growth and market leadership in Nigeria’s food and beverage sector. By focusing on product diversification, operational efficiency, and strategic capital investments, McNichols is well-positioned to capitalize on emerging opportunities and deliver sustained value to its shareholders.