Marathon Digital Holdings, Inc. (NASDAQ: MARA): An In-Depth Financial Analysis

Marathon Digital Holdings, Inc., commonly known as MARA, is a prominent player in the cryptocurrency mining sector. The company, headquartered in Las Vegas, Nevada, has been making waves since its inception with its aggressive expansion and focus on Bitcoin mining. However, like many companies in the volatile cryptocurrency space, Marathon Digital has experienced its share of ups and downs.

A Meteoric Rise and a Harsh Reality Check

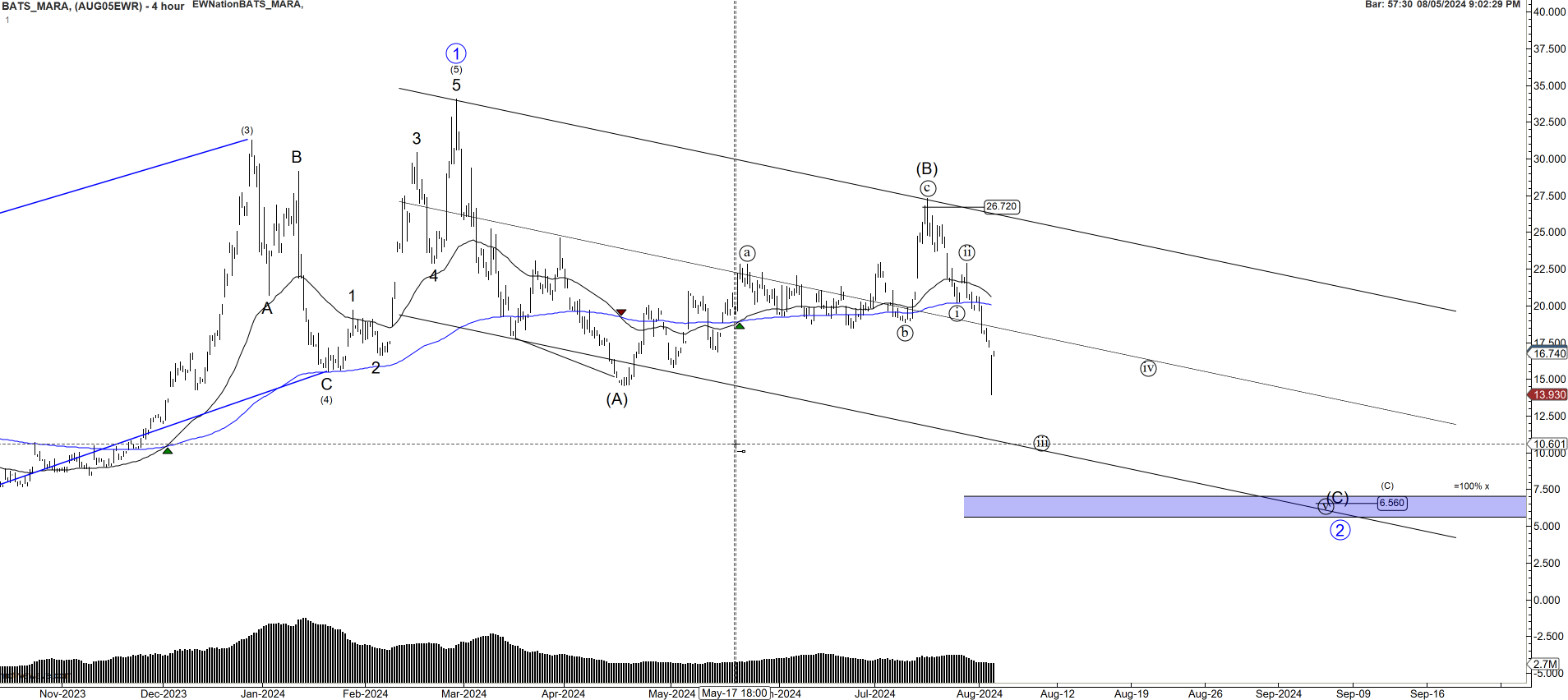

Marathon Digital went public in 2011 and has seen its stock price soar, particularly during the cryptocurrency boom. The stock reached an all-time high of $83 in November 2021, fueled by the surging price of Bitcoin and investor enthusiasm for cryptocurrency-related stocks. However, the subsequent months were less kind to MARA, mirroring the broader crypto market’s downturn. Between November 2021 and September 2022, Marathon Digital’s stock plummeted by approximately 75%, dropping from $83 to around $21. This decline can be attributed to a combination of falling Bitcoin prices, increasing operational costs, and broader market corrections. Despite these challenges, MARA has maintained a robust revenue growth trajectory, driven by its expanding mining operations.

Financial Performance: Profitability and Challenges

Marathon Digital has shown impressive revenue growth, with quarterly revenues increasing significantly year-over-year. However, the company has struggled with profitability, a common issue in the capital-intensive cryptocurrency mining industry. While MARA reported positive net income in the last two quarters, these profits were primarily on paper. The company’s free cash flow remains negative, indicating ongoing operational and capital expenditure challenges. Additionally, Marathon Digital’s balance sheet has become more leveraged. The company took on significant debt to finance its expansion, including the purchase of new mining equipment and the development of its data centers. As of 2023, MARA’s debt load has increased to nearly $300 million, adding financial pressure amidst a volatile market environment.

Stock Recovery and Valuation Concerns

Despite the turbulent period, Marathon Digital’s stock has shown a remarkable recovery from its September 2022 low of $21. As of August 2024, the stock trades at around $38, reflecting renewed investor confidence and a more favorable outlook for Bitcoin prices. Currently, MARA trades at a price-to-sales (P/S) ratio of approximately 10 and a forward price-to-earnings (P/E) ratio of over 50, based on estimated 2024 earnings. While these valuations might seem steep, they are not uncommon in the high-growth tech and crypto sectors. However, investors should remain cautious. Valuation metrics often play a secondary role in bullish markets, but they can quickly come to the forefront if market sentiment shifts.

Conclusion: A Cautious Optimism

Marathon Digital Holdings stands at a crossroads. The company’s future performance is closely tied to the volatile cryptocurrency market, particularly Bitcoin prices. While its aggressive expansion and operational improvements are commendable, the high debt levels and negative free cash flow are significant concerns. For investors, MARA presents a high-risk, high-reward opportunity. The stock’s recovery from its lows is encouraging, but the high valuation and ongoing financial challenges suggest that caution is warranted. As with any investment in the crypto sector, potential investors should be prepared for volatility and remain vigilant about the company’s financial health and market conditions.