The Elliot Wave Chart above shows that Japaul is still within a sideways correction. Unfolding is a triangle printed above as A-B-C-D-E, the current move from 2.1 NGN is impulsive making the A wave of triangle D wave and we expect a target of 2.69NGN for Wave D. Above 2.9 invalidates this chart.

Categories

Forex

+-

-

Sep 13, 2025 Premium

Sep 13, 2025 Premium -

Aug 26, 2025 Premium

Aug 26, 2025 Premium

Crypto

+-

Sep 18, 2025 Premium

Sep 18, 2025 Premium -

Sep 18, 2025 Premium

Sep 18, 2025 Premium -

Sep 18, 2025

Sep 18, 2025

US Stock

+-

Sep 9, 2025

Sep 9, 2025 -

Aug 21, 2025 Premium

Aug 21, 2025 Premium -

Aug 15, 2025 Premium

Aug 15, 2025 Premium

NGX Stock

−-

Sep 23, 2025 Premium

Sep 23, 2025 Premium -

Sep 23, 2025 Premium

Sep 23, 2025 Premium -

Sep 22, 2025 Premium

Sep 22, 2025 Premium

Gold and Silver

+-

Sep 6, 2025 Premium

Sep 6, 2025 Premium -

Jul 7, 2025

Jul 7, 2025

Crude Oil

+-

Sep 6, 2025 Premium

Sep 6, 2025 Premium -

Aug 6, 2024

Aug 6, 2024

You May

Also

Like

Oando September 23rd 2025 Update...

Oando September 23rd 2025 Update...

Oando September 23rd 2025 Update...

DangSugar September 23rd 2025 Update...

Ellahlakes September 22th 2025 Update...

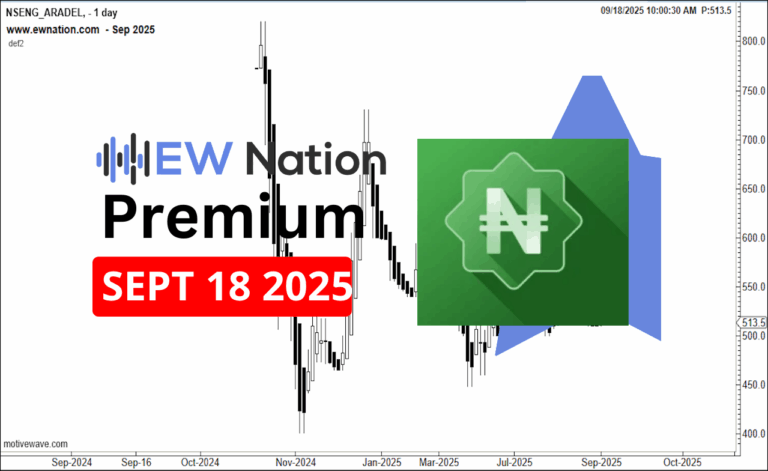

Aradel September 18th 2025 Update...

Learn More about Elliot Wave Theory

Our Clients Reviews

Read what our clients have to say about their experience with EWNation.