Japaul Gold & Ventures (JAPAULGOLD) is a Nigerian-based company focused on mining, exploration, and the extraction of precious metals, primarily gold. Originally established as an oil and maritime services company, Japaul restructured its operations in recent years to capitalize on the growing demand for gold and other natural resources. The company is involved in mining activities across Nigeria and other parts of Africa, positioning itself in a high-potential market due to the increasing global demand for gold.

Japaul Gold underwent a strategic shift from its former operations to focus on mining, seeing it as a more lucrative and sustainable venture. The transition has helped the company tap into the abundant natural resources available in Nigeria and other African countries, allowing it to diversify its revenue streams and reduce its reliance on the oil and gas sector.

The company’s stock has experienced significant volatility, reflecting challenges in the broader Nigerian economy as well as the inherent risks associated with mining, such as fluctuating commodity prices and regulatory pressures. Despite these hurdles, Japaul Gold’s pivot to mining could offer long-term growth potential, especially as the global demand for gold remains strong and the company continues to explore new mining opportunities.

Investors in Japaul Gold should consider the high risks and rewards associated with mining operations in emerging markets, as well as the potential for future gains as the company refines its focus on gold production.

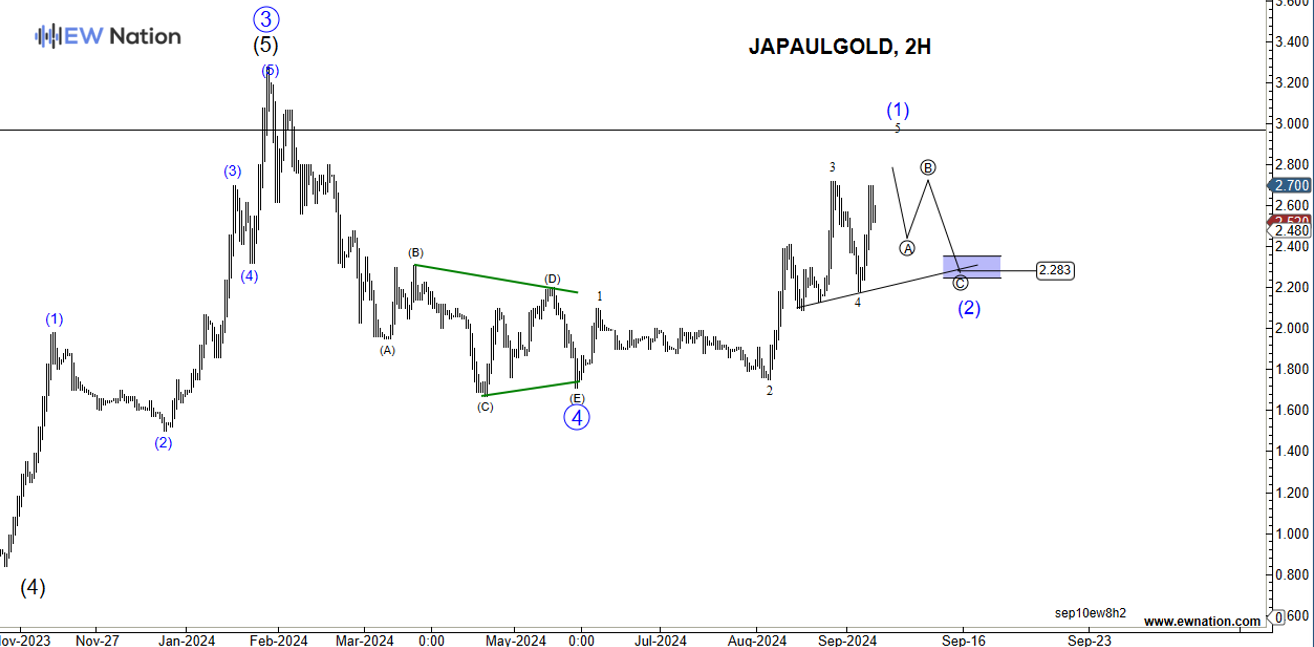

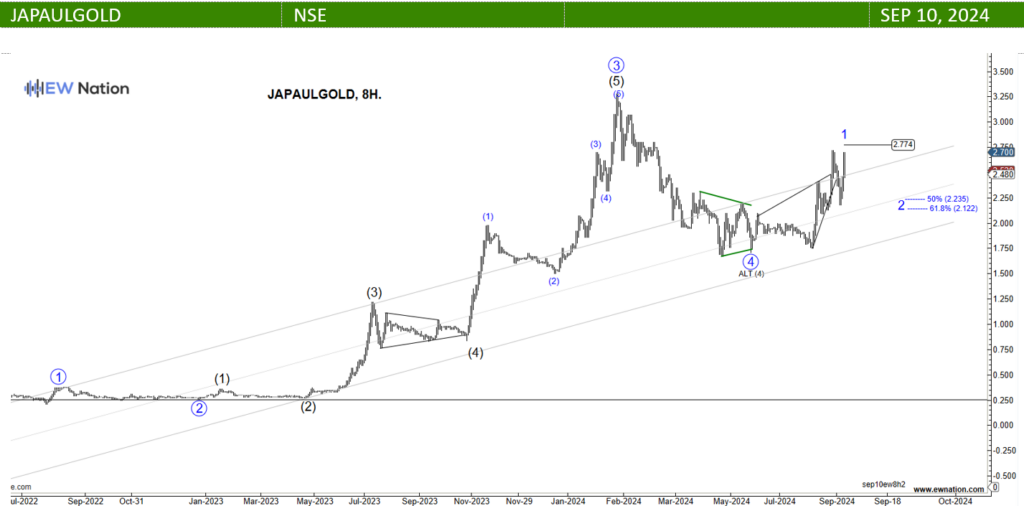

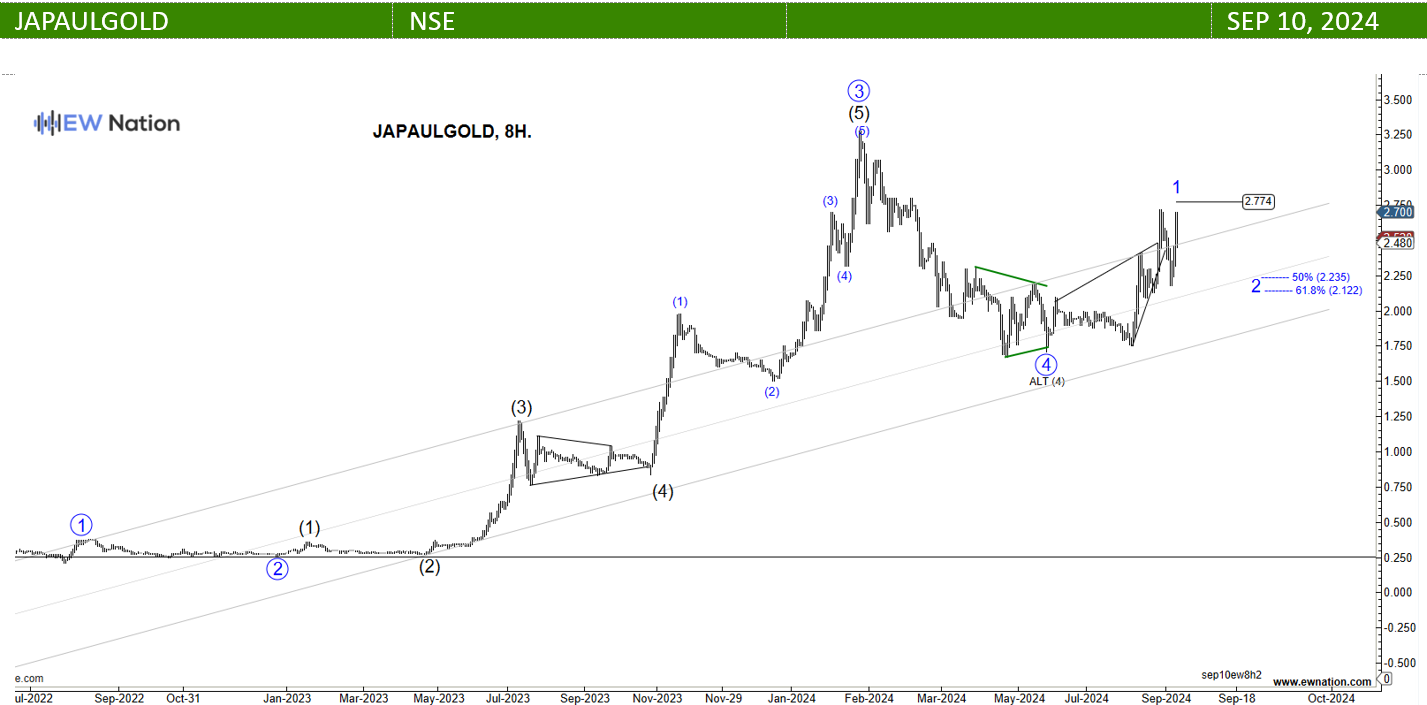

iJapaul Gold’s 8H chart revealed that thee structure of the decline from 3.2N was corrective. We labeled it as (a)-(b)-(c)-(d)-(e) in below chart. According to the Elliot wave theory, once a correction is over the preceding trend resumes. Japaul Gold was obviously in an uptrend prior to February 2024 , so it made sense to expect a recovery as soon as wave 4 ended.

That didn’t take very long. Japaul Gold started rising, Q3 2024 saw a choppy recovery printing out waves 1 and 2, we expect that wave 1 will hit the 261.8 extension of wave 1 before a correction will ensue for wave 2.

If this count is correct, then Wave 2 should correct towards 2.2 region before resuming the rally.