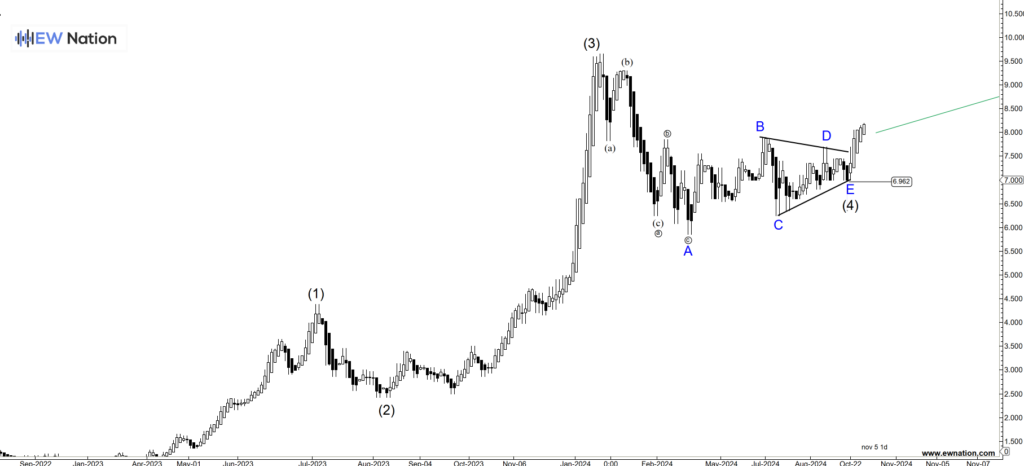

The Elliot Wave chart above shows that IKEJAHOTELS has completed wave 4 at 6.96 region which is 0.386 Fibonacci of wave 3. Wave 3 correction can be seen labelled as A-B-C-D-E.

Categories

Forex

+-

-

Aug 15, 2025 Premium

Aug 15, 2025 Premium -

Aug 14, 2025 Premium

Aug 14, 2025 Premium

Crypto

+-

Aug 23, 2025 Premium

Aug 23, 2025 Premium -

Aug 20, 2025 Premium

Aug 20, 2025 Premium -

Aug 17, 2025 Premium

Aug 17, 2025 Premium

US Stock

+-

Aug 21, 2025 Premium

Aug 21, 2025 Premium -

Aug 15, 2025 Premium

Aug 15, 2025 Premium -

Aug 5, 2025

Aug 5, 2025

NGX Stock

−-

Aug 25, 2025 Premium

Aug 25, 2025 Premium -

Aug 23, 2025 Premium

Aug 23, 2025 Premium -

Aug 23, 2025

Aug 23, 2025

Gold and Silver

+Crude Oil

+-

Aug 6, 2024

Aug 6, 2024

You May

Also

Like

JapaulGold August 25th 2025 Analysis...

Oando August 25h 2025 Update...

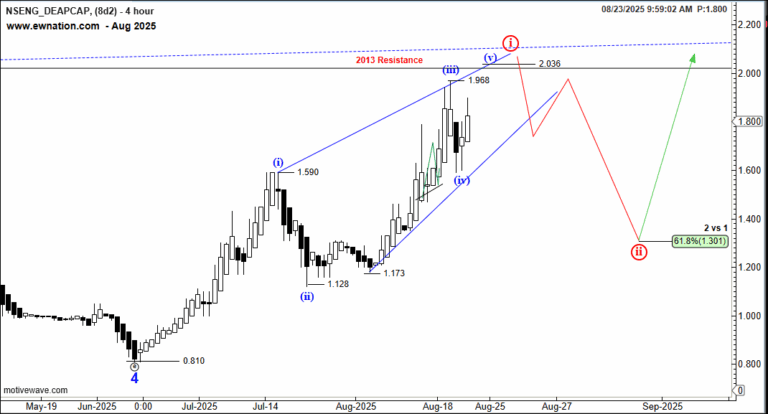

DEAPCAP, a high risk speculative asset, offers price appreciation potential, evidenced by strong...

ATOMUSDT Analysis August 23th, 2025...

HMCALL August 25th Update...

ConhallPLC Has Some Falling To Do...

Learn More about Elliot Wave Theory

Our Clients Reviews

Read what our clients have to say about their experience with EWNation.