We first spoke about FTN Cocoa Processors Plc (FTN Cocoa) on September 29, 2024 (https://ewnation.com/is-ftncocoa-stock-a-buy-after-a-67-drop/), highlighting its potential in Nigeria’s growing agricultural export sector despite significant challenges. The company’s recent performance continues to reflect a mix of promise and hurdles.

FTN Cocoa reported revenues of ₦600 million, marking an 8% year-over-year decline, primarily due to operational disruptions and intensified competition in the cocoa processing industry. Gross profit margins remained at 12%, indicating ongoing efforts to stabilize costs amidst external pressures. However, the company’s high debt-to-equity ratio of 1.8 underscores concerns about its leverage, while a quick ratio of 0.7 points to short-term liquidity challenges.

To address these issues, FTN Cocoa has embarked on restructuring efforts, focusing on debt management and improving liquidity. The company is also working to expand exports and build strategic partnerships with local cocoa farmers to secure a stable supply chain. These initiatives align with government programs encouraging agricultural exports, which could enhance the company’s medium-term revenue prospects.

Despite these efforts, FTN Cocoa faces risks such as global cocoa price fluctuations, currency instability, and infrastructure challenges in Nigeria. On the technical side, FTN Cocoa’s stock has shown recent bullish momentum but appears overbought, with a potential pullback offering a better entry point for investors.

FTN Cocoa remains a high-risk, high-reward prospect for investors seeking exposure to Nigeria’s agricultural export sector. Its success hinges on the company’s ability to navigate its operational challenges and capitalize on government incentives to drive long-term growth and profitability.

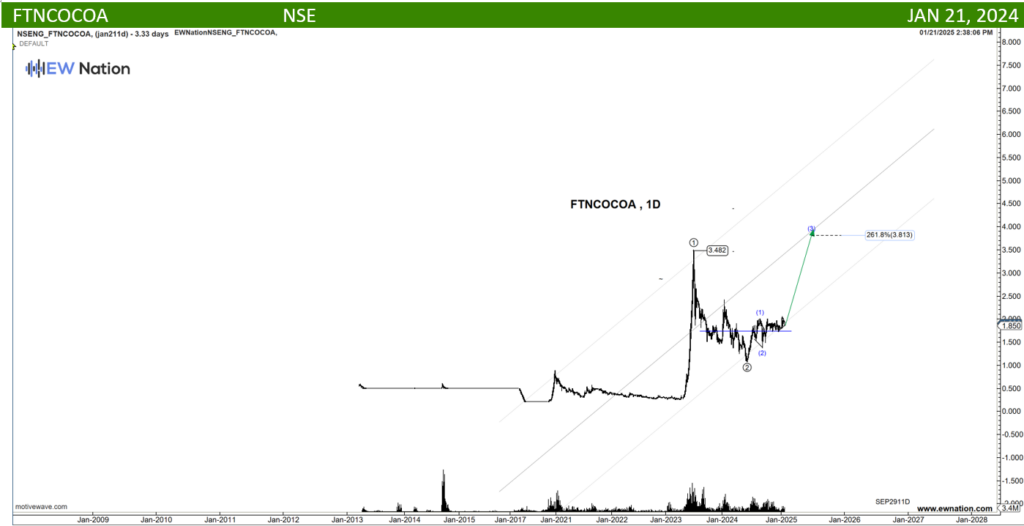

The Elliot Wave chart above shows that FTNCOCOA is in a wave 3 rally. With the move from the 1.070 low to 2 signify a wave 1. Since then we have seen wave 2 printed and the subsequent move from wave 2 unfolding as waves 1 to 4 (in blue) with the wave 4 ending in a triangle A B C D E in circle.

If this count is correct, then we will will see a significant push to the upside to complete wave 5 of the blue impulse.