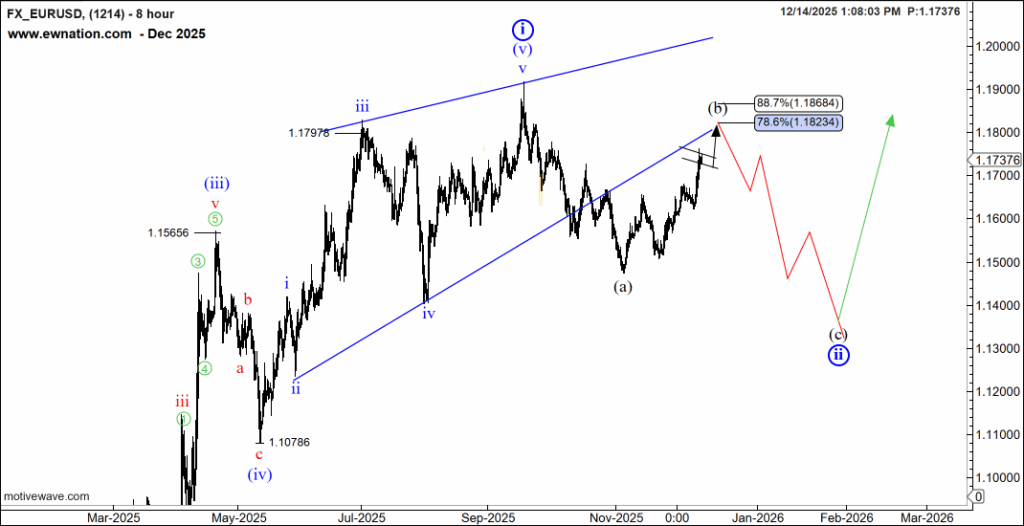

Bottom Line: Higher to complete Wave B

12/14/2025 06:49EST (Last Price 4.96):

The rally from 1.0178 to 1.1919 can be seen as a complete five-wave impulse, marked 1-2-3-4-5 in wave (1), where two lower degrees of the trend are visible within wave 3, and wave 5 is an expanding ending diagonal, marked (i)-(ii)-(iii)-(iv)-(v). If this count is correct, the drop from 1.1919 must be part of a three-wave correction in wave (2), whose wave ‘b’ up is now in progress. It could reach the resistance area near 1.1850, before wave ‘c’ down towards 1.1200 can begin. In fact, if the market picks an expanding flat correction for wave (2), wave ‘b’ could even exceed 1.1919, before the bulls step aside. Only after we’ve seen a complete three-wave structure would I expect the uptrend resume in wave (3).