Categories

Forex

+-

-

Jun 27, 2025 Premium

Jun 27, 2025 Premium -

Apr 30, 2025 Premium

Apr 30, 2025 Premium

Crypto

+-

Jul 13, 2025 Premium

Jul 13, 2025 Premium -

Jul 10, 2025 Premium

Jul 10, 2025 Premium -

Jul 10, 2025 Premium

Jul 10, 2025 Premium

US Stock

+-

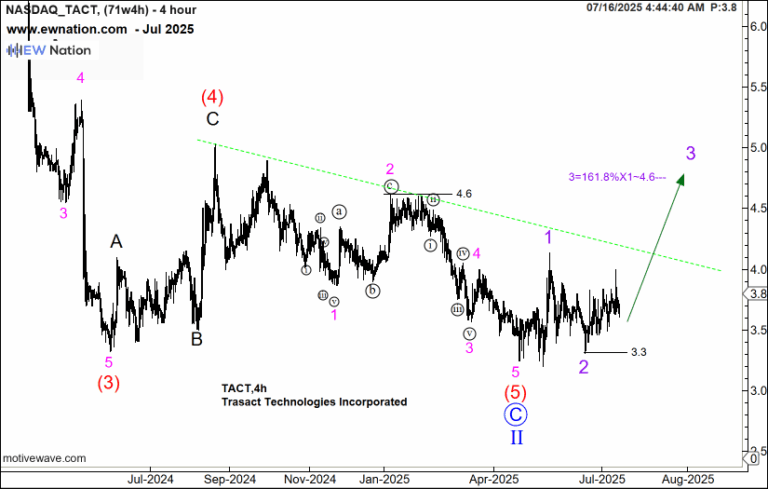

Jul 16, 2025

Jul 16, 2025 -

Jul 11, 2025 Premium

Jul 11, 2025 Premium -

Jul 7, 2025

Jul 7, 2025

NGX Stock

−-

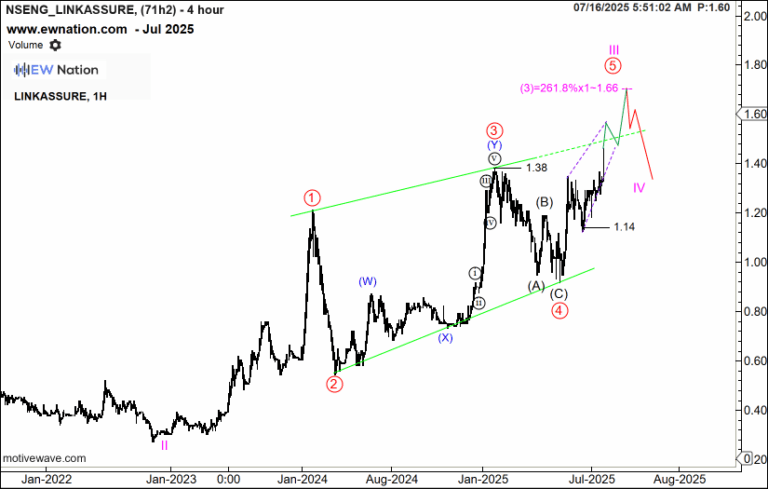

Jul 16, 2025 Premium

Jul 16, 2025 Premium -

Jul 16, 2025 Premium

Jul 16, 2025 Premium -

Jul 16, 2025

Jul 16, 2025

Gold and Silver

+Crude Oil

+-

Aug 6, 2024

Aug 6, 2024

eTranzact International PLC’s P/E ratio of 18.4x is higher than the Nigerian market average of 6.8x but aligns with fintech peers, suggesting a fair valuation with growth potential priced in. Its robust revenue growth (₦29.8 billion in 2024), innovative products, SME focus, and global expansion plans make it a compelling investment in Nigeria’s burgeoning fintech sector.

From the chart above, the move from the top in Q4 2023 has unfolded in a 3 waves highly suggesting a wave 2 structure. Conversely, the move from the ₦4.57 low is a wave 1 of a smaller degree, this move means that the bull have come in and will sustain the move upwards. With the wave 2 of a smaller degree printed following the a-b-c correction, our focus is now to the upside for the completion of the wave 1 of a larger degree.

If this count is correct, target for the completion of this wave is ₦11.5.

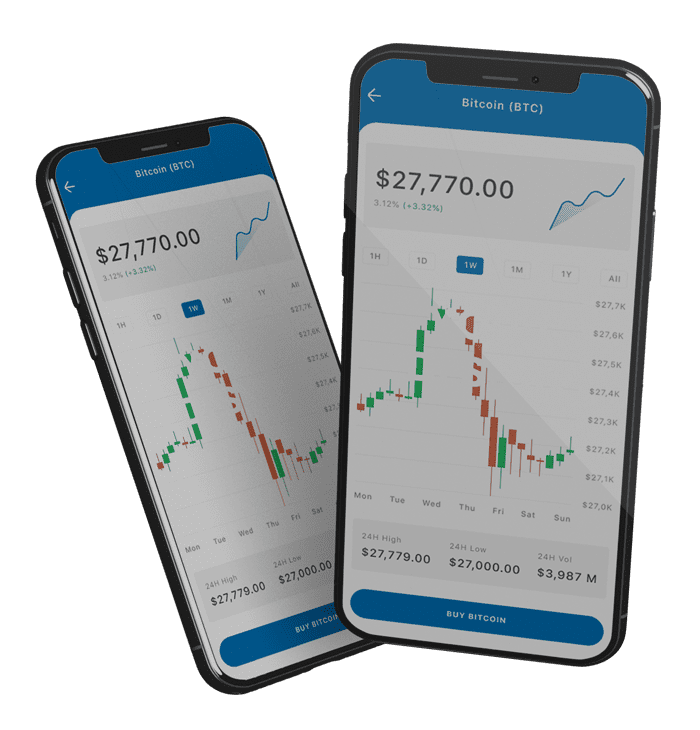

In our Elliot Wave Premium subscriptions we provide analyses of Cryptocurrencies and forex. Check them out now!

Previous Articles

Learn More about Elliot Wave Theory

Our Clients Reviews

Read what our clients have to say about their experience with EWNation.