Ecobank Transnational Incorporated (ETI, ticker: ETI) is a top pan-African bank operating in 35 countries. Listed on the Nigerian Exchange with a ₦639.41 billion market cap, ETI delivers retail, corporate, and investment banking. Here’s a quick look at its financials, stock trends, and strategy, based on sources from the past four months.

Financial Highlights

ETI’s Q1 2025 profit after tax surged 17% to $122.5 million from $105 million in Q1 2024. Full-year 2023 revenue grew 4.07% to $1.73 billion, with earnings up 0.49% to $287.82 million. Earnings per share are ₦0.01, but Morningstar notes a 133% trading premium, hinting at overvaluation.

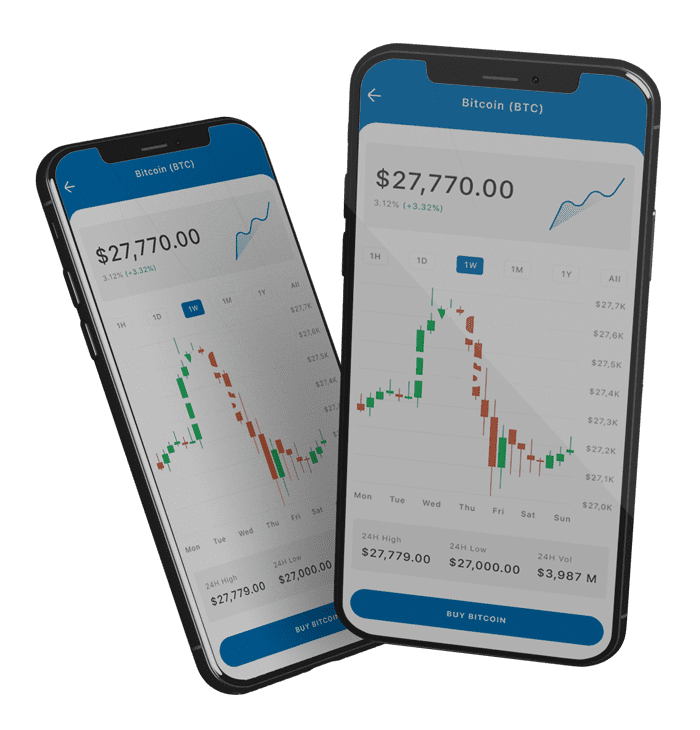

ETI’s stock trades at ₦24.95, with doubled trading volume signaling investor interest. Technical indicators lean “Strong Sell” due to moving averages, urging caution. Monitor price-to-earnings and dividend yield for value.

Strategy and Growth

ETI raised $700 million via bonds in 2025, boosting liquidity for SME lending. Its Ellevate program supports women-led businesses, while the Fintech Challenge drives innovation. Partnerships with Thunes and Ezra enhance digital banking.

Risks

Nigeria’s FX constraints and economic volatility pose risks. Anecdotal investor complaints about returns highlight the need for due diligence.

Bottom Line

ETI offers strong growth potential in African banking, but its premium valuation and Nigeria’s risks demand careful analysis. Check financials on Investing.com and Stock Analysis before investing.

Disclaimer: For informational purposes only. Consult a financial advisor before investing.

From the chart above, ETI is in a wave 2 correction.