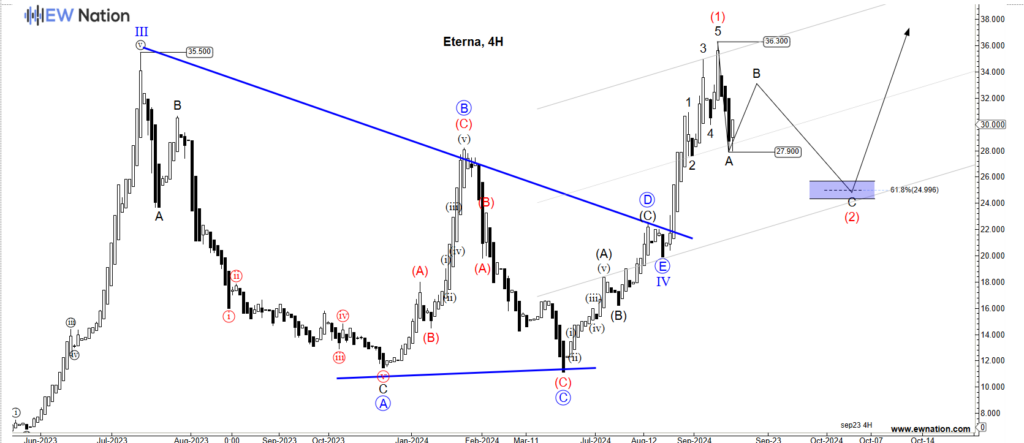

Eterna Follows Its Elliot Wave Path

The first time we posted about Eterna was in late March, 2024, Elliot Wave analysis suggested to expect a Wave 4 triangle with a Wave D around 25.472. This worked accordingly although with the Wave 4 not retracing as much as planned. Eterna then rallied to a high of 36.3 which can be denoted as wave 1 of 5. When an quality company like Eterna gets significantly devalued in such a short order, investors often rush to buy the dip.

Eterna Plc, a key player in downstream oil and gas sector, has shown resilience in a challenging market environment. Specializing in petroleum products, lubricants, and gas, the company has been gradually expanding its operations, with a focus on increasing its market share in both retail and industrial segments. As the global energy landscape evolves, Eterna has begun positioning itself for long-term growth by diversifying its offerings and improving operational efficiency.

In its most recent financial results, Eterna reported revenue of ₦102.7 billion, marking a 15% year-over-year increase, driven by higher sales volumes in its petroleum product distribution and lubricant segments. Despite this revenue growth, Eterna’s profitability was impacted by rising costs, including foreign exchange volatility, which affected importation costs. The company posted a net income of ₦1.7 billion, representing a slight recovery from previous quarters. Eterna has been actively working on cost optimization strategies to enhance its margins and improve overall profitability.

With a price-to-earnings (P/E) ratio of 7.6, Eterna is seen as an undervalued stock within the Nigerian energy market. Analysts are optimistic about the company’s future growth prospects, especially as it expands its footprint in the liquefied petroleum gas (LPG) and lubricant markets. Additionally, ongoing reforms in Nigeria’s oil and gas sector, such as the Petroleum Industry Act (PIA), are expected to provide new growth opportunities for companies like Eterna, which have a diversified portfolio and strong operational capabilities.

However, Eterna faces risks tied to Nigeria’s broader economic challenges, including inflation, currency depreciation, and regulatory changes. Despite these headwinds, the company remains resilient, and its commitment to expanding its product offerings and improving efficiency provides a positive outlook for long-term growth. Investors looking to tap into Nigeria’s evolving energy market may find Eterna Plc an attractive opportunity with solid upside potential.

The Elliot Wave chart above shows that the ETERNA has completed wave 1 of 5. After an impulse, then we expect a retracement in 3 waves A-B-C. The target for the wave 2 of this impulse is the 25 region then the impulse will continue to the upside.

If this count is correct, we expect that short term decline to the 25 region.