Ellah Lakes Plc – Opportunity or Something Else

We first posted charts about Ellah Lakes in our discord group (join here) on March 18th, 2024 and recently August 28th, 2024 suggesting that Ellah Lakes had completed and ending diagonal. Per Elliot Wave Theory, an ending diagonal often precedes an impulse to the upside or another rally.

Ellah Lakes Plc, a key player in Nigeria’s agricultural sector, has been making strides in recent years as it focuses on expanding its operations in oil palm and cassava farming. After transitioning from a fish farming business, the company is strategically positioning itself to take advantage of the growing demand for agricultural products both locally and internationally. As the Nigerian government continues to emphasize self-sufficiency in agriculture, Ellah Lakes is poised for significant growth.

In its most recent financial results, Ellah Lakes reported a revenue of ₦3.4 billion, reflecting an 18% year-over-year growth. This was primarily driven by increased production and higher demand for its agricultural outputs, particularly in the oil palm sector. However, rising operational costs and challenges with logistics in rural areas have impacted the company’s profitability. The company posted a modest net profit of ₦150 million, showing improvement as it works to optimize its production and supply chain processes.

Trading at a price-to-earnings (P/E) ratio of 7.8, Ellah Lakes is currently seen as an undervalued stock within Nigeria’s agribusiness market. Analysts are optimistic about the company’s long-term prospects, especially as it continues to scale its operations in the oil palm industry. The company’s efforts to increase its land bank and implement mechanized farming practices are expected to enhance productivity and drive future revenue growth.

However, like many agricultural companies in Nigeria, Ellah Lakes faces risks associated with climate change, infrastructure challenges, and fluctuating commodity prices. Despite these headwinds, the company’s strategic initiatives, including partnerships and expanding its landholdings, provide a positive outlook for sustained growth, making it an interesting option for investors looking to tap into Nigeria’s agricultural potential.

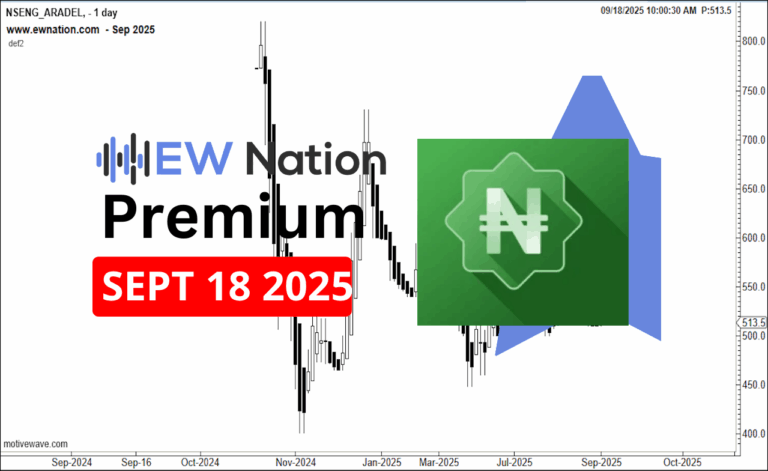

Per earlier post on Ellah Lakes, there are a couple of resistances that Ellah Lakes will have to overcome before we can see a substantial rally, this is why we believe that the asset will be in sideways movement for a bit to complete what is unfolding as a leading diagonal pattern labeled 1-2-3-4-5 in the diagram below.

If this count is correct, we expect that short term decline to the 3.2 for wave 4.