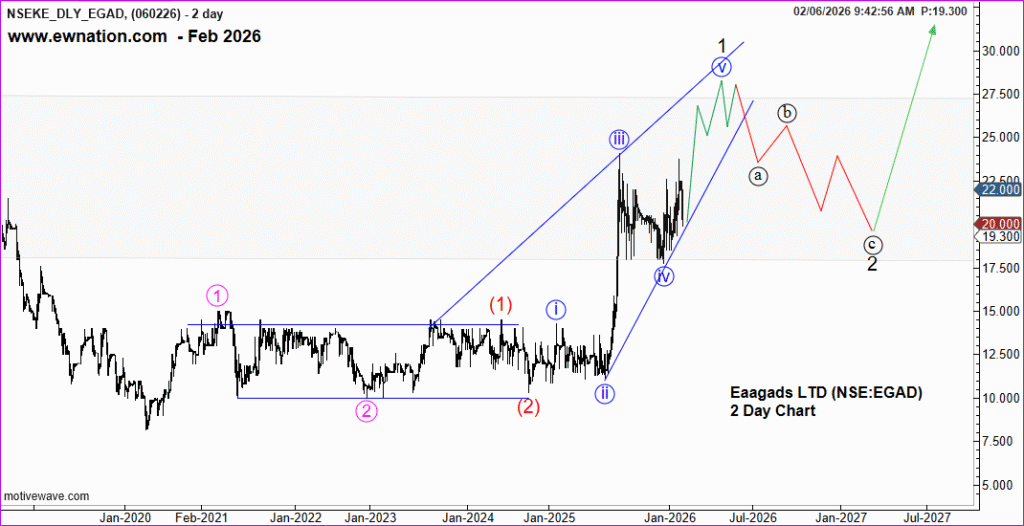

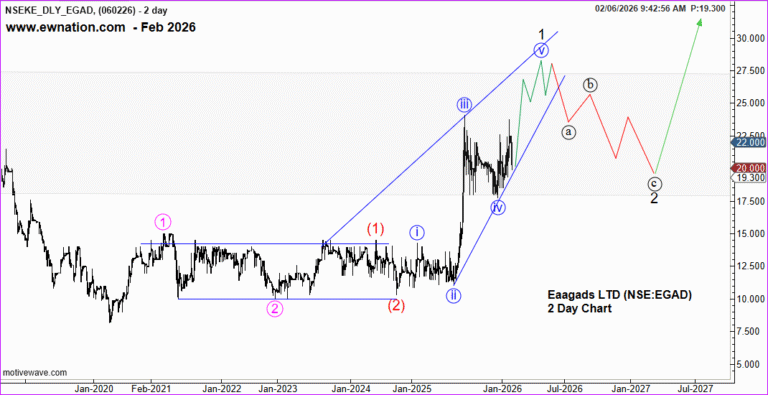

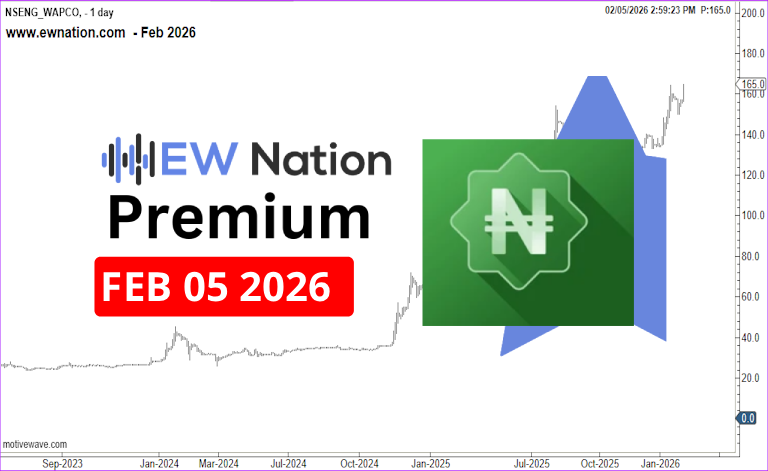

Bottom Line: Higher in five waves for wave 5

2/6/26 08:40 EST (Last Price 22):

With 17.75 still intact, we will keep the focus higher in wave 5 connection alive.

Summary

Sector: Agriculture (Coffee)

Market Cap: ~KES 700 million

Share Price: ~KES 22 (at time of writing)

Business Overview

Eaagads Ltd is a Kenya-based agricultural company primarily engaged in Arabica coffee production. The company offers listed exposure to the global coffee market, with earnings largely driven by international coffee prices, production volumes, and weather conditions.

Recent Performance

The company reported a strong rebound in earnings, supported by higher global coffee prices and improved sales volumes. Revenue and profitability have both improved year-on-year, reflecting better price realization despite ongoing structural challenges in the coffee sector.

Valuation

At current levels, EGAD trades at a high earnings multiple, implying that the market is pricing in continued earnings improvement. However, the stock trades below book value, which may appeal to asset-focused investors. Earnings yield remains modest, suggesting valuation support depends on future growth rather than current income.

Outlook

The broader coffee price environment remains supportive, while indications of production recovery could further strengthen earnings. That said, short-term volatility is likely, driven by thin liquidity, cyclical earnings, and agricultural risk factors.