C&I Leasing Plc (Ticker: CILEASING) Financial Analysis: Signs of Recovery Amid Industry Challenges

C&I Leasing Plc, a leading provider of logistics, leasing, and maritime services in Nigeria, has experienced a mixed financial performance over the past few years. The company faced challenges due to Nigeria’s tough economic environment, which impacted its revenue streams and profitability. However, CILEASING is showing signs of recovery, with its stock price witnessing moderate growth, thanks to strategic operational adjustments and a focus on expanding its service offerings in various sectors, including oil and gas, and fleet management.

In its most recent financial report, C&I Leasing posted a revenue of ₦22.6 billion, reflecting a 9% year-over-year growth, driven largely by its offshore support services and fleet management divisions. Despite these gains, the company reported a net profit of ₦1.1 billion, up from a ₦900 million profit the previous year, indicating that its cost-reduction strategies are starting to yield results. This profitability boost has attracted investor attention, particularly as CILEASING continues to maintain a strong position in Nigeria’s maritime and leasing sectors.

Trading at a price-to-earnings (P/E) ratio of 7.4, CILEASING is still considered undervalued compared to its industry peers, offering potential for upside as the company works to stabilize its operations. The recent recovery in the oil and gas sector, coupled with the growing demand for maritime logistics services, has provided CILEASING with a favorable backdrop for expansion. Analysts are beginning to see a potential for a rally in the stock price, supported by the company’s improving financial health and an anticipated increase in fleet management demand.

However, the company still faces risks, such as foreign exchange fluctuations and the volatility of oil prices, which could impact its revenue streams. Nonetheless, with its solid market position and efforts to streamline operations, CILEASING appears well-positioned to continue its recovery trajectory. Investors looking for exposure to Nigeria’s logistics and maritime sectors may find CILEASING’s current stock price an attractive entry point, especially given its potential for long-term growth.

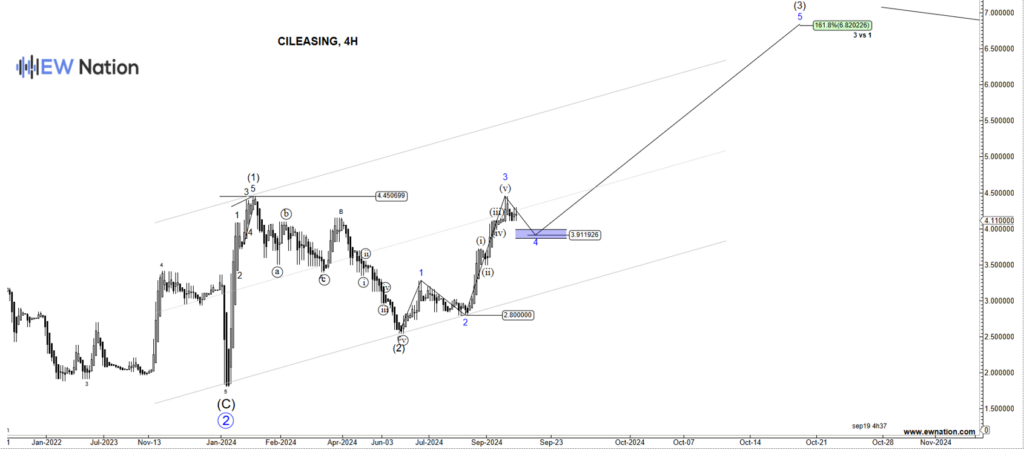

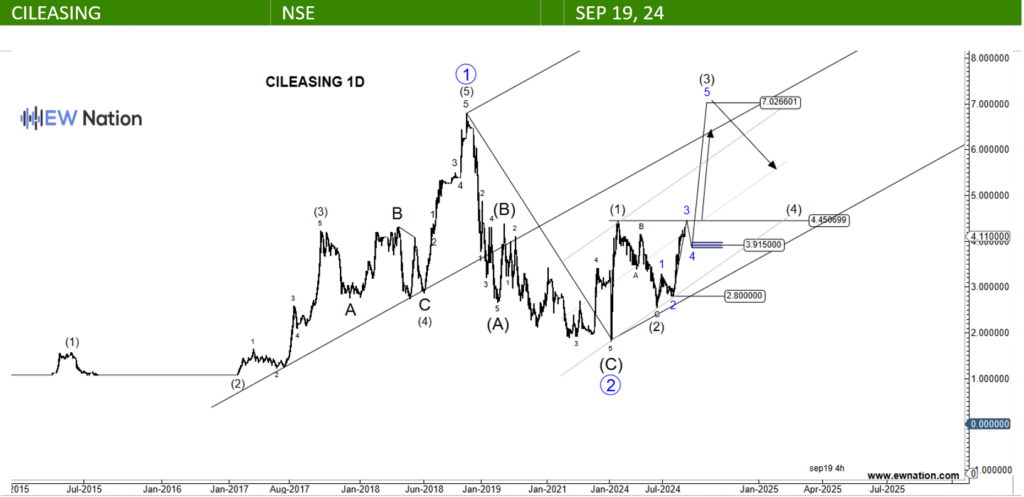

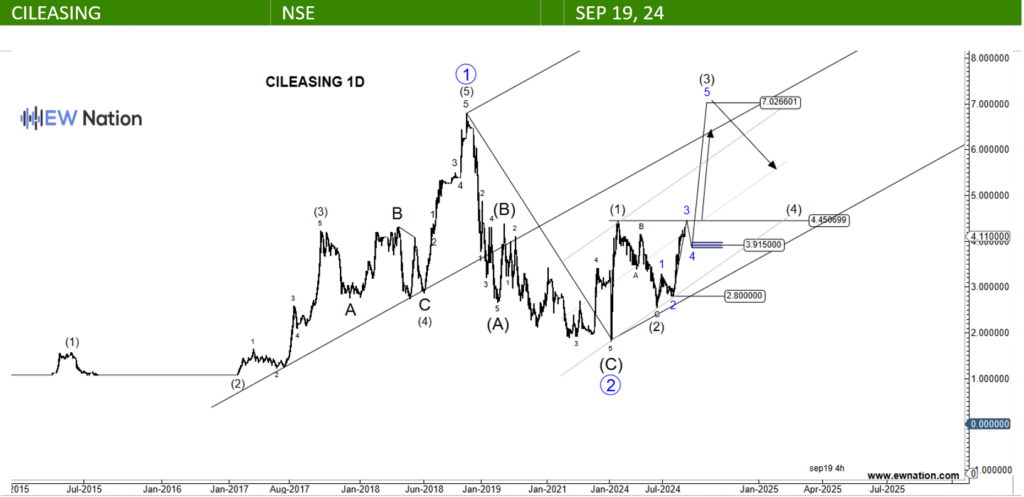

The Elliot Wave chart above shows that the CILeasing has commenced a Wave 3 having completed a Wave 1 at N7. The impulsive move from the low of January 2024 suggests that a new trend or corrective pattern has commenced. At this point, our Analysts are sticking to the wave 1 option.

If this count is correct, we expect that short term target to be around the 7 region to test the wave 1 high.