In our November 2024 article titled “Conhall PLC: Playing a Waiting Game,” we discussed the company’s cautious approach amid market uncertainties. Since then, Consolidated Hallmark Insurance Plc (CHI) has experienced a remarkable 200% surge in its stock price, prompting a reevaluation of its financial performance and strategic direction.

Company Overview

Consolidated Hallmark Insurance Plc is a leading general business insurance company in Nigeria, offering a wide range of products including motor, gadget, home, and business insurance. Established on August 2, 1991, the company has grown through strategic mergers, notably with Hallmark Assurance Plc and Nigerian General Insurance Company, effective from March 1, 2007.

Financial Performance

As of December 31, 2024, CHI’s stock reached a new 52-week high of NGN 3.45, marking a 159.40% increase over the period.

This surge reflects the company’s robust financial health and investor confidence.

In the second quarter of 2023, CHI reported a gross premium written of NGN 10.5 billion, indicating a strong underwriting performance. The profit before tax grew by 26%, from NGN 772.5 million in 2020 to NGN 971.6 million in 2021, demonstrating effective cost management and operational efficiency.

Strategic Developments

CHI has diversified its services through subsidiaries such as CHI Capital Limited, offering consumer leasing and financial management services, and CHI Microinsurance Limited, providing life microinsurance services. These expansions have contributed to the company’s revenue streams and market presence.

Market Context

The Nigerian insurance industry has been evolving, with companies like CHI adapting to changing consumer needs and technological advancements. CHI’s commitment to reducing anxiety and catering to customer needs has positioned it favorably in the market.

Conclusion

The 200% increase in CHI’s stock price since November 2024 underscores the company’s strong financial performance, strategic diversification, and positive market perception. Investors and stakeholders should continue to monitor CHI’s developments, as its proactive strategies and robust financial health suggest a promising trajectory in Nigeria’s insurance sector.

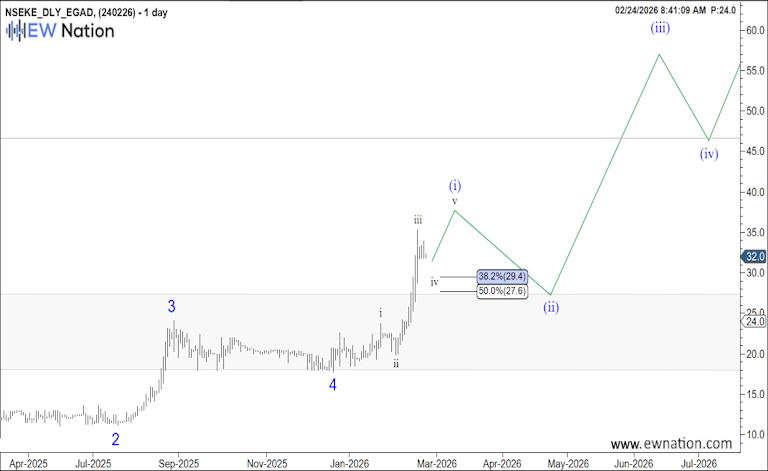

The Elliot Wave chart above suggests that CONHALL PLC may be making a Wave c, this is a correction to the larger wave B position. Two particular key areas to watch are the 0.618 and 100 fibonacci levels of wave A as indicated in the chart.

If this count is correct, then we will expect that the asset will continue its rally once this move is completed.