Financial Analysis: Consolidated Hallmark Insurance Plc (CONHALL)

Consolidated Hallmark Insurance Plc (CONHALL), a leading player in Nigeria’s insurance sector, has demonstrated resilience amid challenging economic conditions. In recent financial disclosures, CONHALL reported gross premium earnings of over ₦11 billion, reflecting steady demand for its core insurance products, including general, motor, and health insurance. This growth, even in the face of rising inflation and a volatile economic environment, underscores the strength of the company’s diversified insurance offerings.

Despite these positive developments, CONHALL has faced higher operational costs, particularly due to inflation and rising claims. However, through effective underwriting and risk management strategies, the company maintained a healthy underwriting profit of ₦1.2 billion, showcasing its ability to navigate economic uncertainties while preserving profitability.

Looking forward, Consolidated Hallmark Insurance is investing in digital transformation, expanding its customer reach with new online products and claims processing technologies aimed at enhancing customer experience and operational efficiency. As demand for insurance grows in Nigeria, CONHALL is positioned to capitalize on emerging opportunities in the sector, with a particular focus on expanding its health and microinsurance products. Investors may view the company’s proactive approach to digitalization and strategic product expansion as a solid foundation for long-term growth in the evolving Nigerian insurance market.

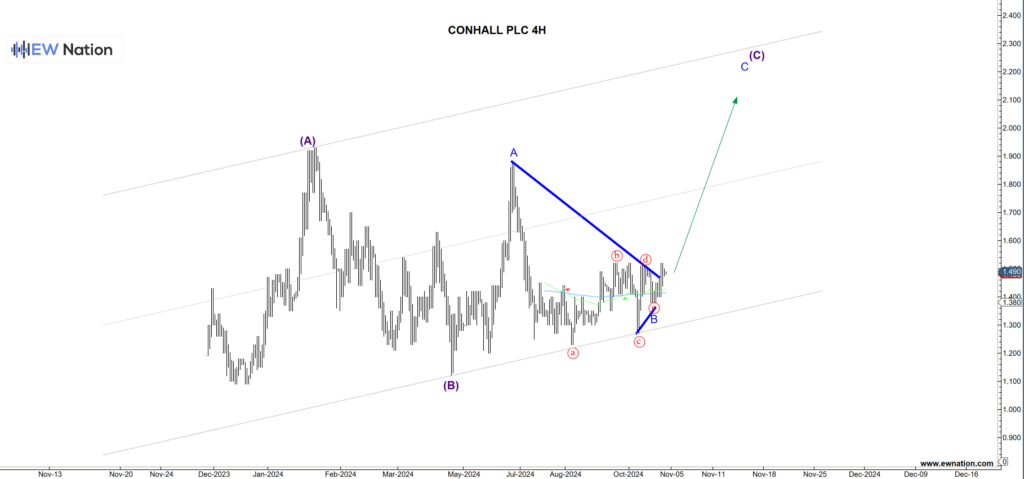

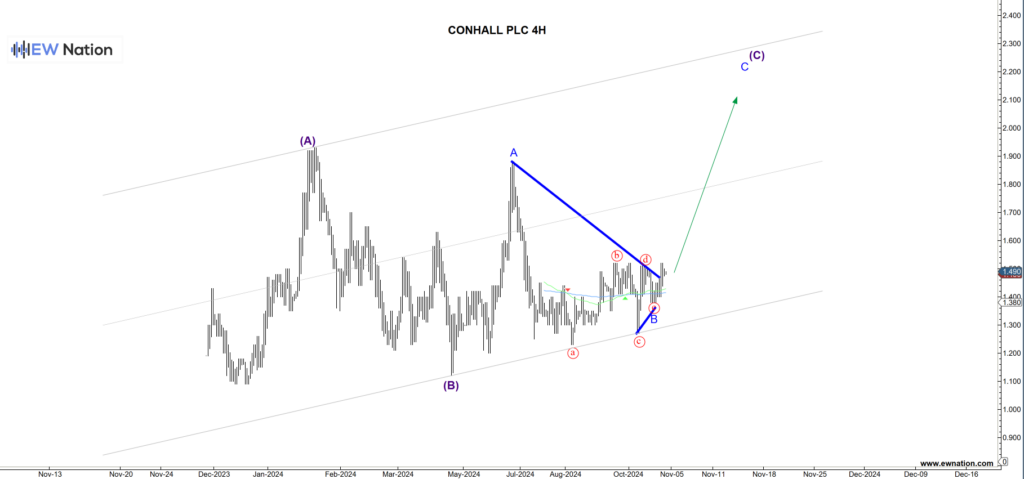

CONHALL PLC has met the criteria for a B wave having completed an (a)-(b)-(c)-(d)-(e) triangle pattern. We expect that the asset will continue to unfold as a wave C to the upside. The high at 1.52 has completed 5 waves move suggesting that it is that wave 1 of a new impulse pattern. If this count is correct then we will expect the impulse to continue after the wave 2 correction with target at 1.406 (6.18 Fibonacci of wave 1).