Categories

Forex

+-

-

Jun 27, 2025 Premium

Jun 27, 2025 Premium -

Apr 30, 2025 Premium

Apr 30, 2025 Premium

Crypto

+-

Jul 31, 2025 Premium

Jul 31, 2025 Premium -

Jul 31, 2025 Premium

Jul 31, 2025 Premium -

Jul 31, 2025 Premium

Jul 31, 2025 Premium

US Stock

+-

Jul 31, 2025 Premium

Jul 31, 2025 Premium -

Jul 17, 2025

Jul 17, 2025 -

Jul 16, 2025

Jul 16, 2025

NGX Stock

+-

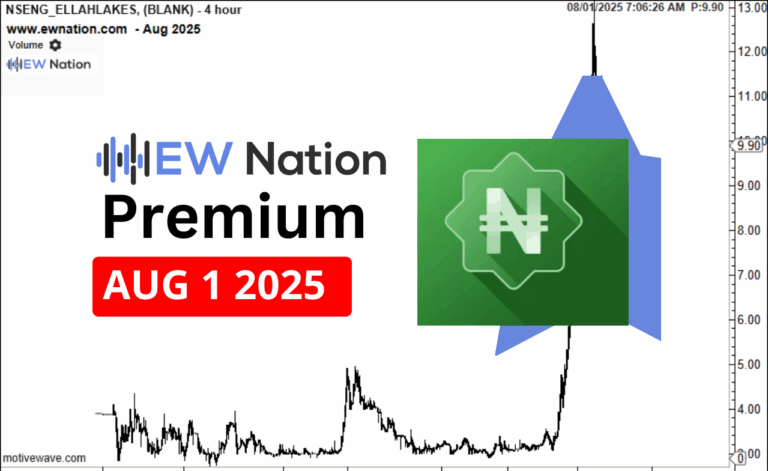

Aug 1, 2025 Premium

Aug 1, 2025 Premium -

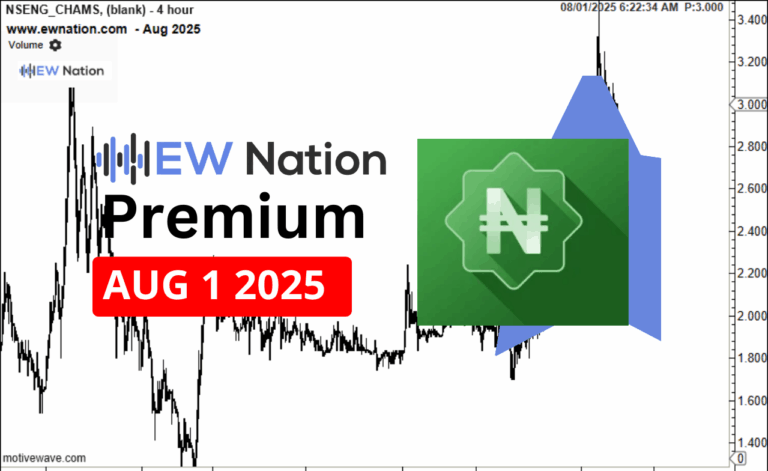

Aug 1, 2025 Premium

Aug 1, 2025 Premium -

Jul 30, 2025 Premium

Jul 30, 2025 Premium

Gold and Silver

+Crude Oil

+-

Aug 6, 2024

Aug 6, 2024

Chams Holding Company Plc, formerly known as Chams Plc, is a Nigerian provider of integrated technology solutions, specializing in identity management, payment collections, and transactional systems. Established in 1985, the company has evolved into a key player in Nigeria’s technology sector, offering a diverse range of services through its subsidiaries.

Company Overview

Chams operates through several subsidiaries, each focusing on distinct aspects of technology solutions:

ChamsSwitch: Specializes in remittances, card payment processing, and financial services, providing a robust e-payment platform capable of integrating with various financial systems.

ChamsMobile: Offers mobile money accounts supported by a nationwide financial services agent infrastructure, enhancing financial inclusion across Nigeria.

CardCentre Nigeria Limited (CCNL): Provides comprehensive end-to-end identity management, digital security, and payment solutions, including smart card personalization.

ChamsAccess: Focuses on delivering innovative technology solutions for individuals and businesses, contributing to the group’s diversified service offerings.

Financial Performance

As of February 21, 2025, Chams’ stock price was NGN 2.30, slightly below its 52-week high of NGN 2.53 set on January 6, 2025.

The company’s market capitalization stood at approximately NGN 9.77 billion, representing about 0.017% of the Nigerian Stock Exchange equity market.

In the most recent financial reports, Chams reported a net income of NGN 186.24 million for the last quarter, reflecting a 6.47% increase from the previous quarter’s net income of NGN 174.91 million.

This growth indicates improved profitability and operational efficiency.

Over the past year, Chams’ stock has experienced a slight decrease of 2.08%. However, the company’s stock reached an all-time high of NGN 3.65 on January 19, 2024, and an all-time low of NGN 0.20 on December 12, 2018, showcasing significant volatility over the years.

Strategic Developments

Chams has been actively involved in various strategic initiatives to strengthen its market position:

Identity Management Projects: The company has executed identification and verification projects for major institutions, including the Independent National Electoral Commission (INEC), Nigerian Communications Commission (NCC), National Health Insurance Scheme (NHIS), and the Nigerian Air Force.

Bank Verification Number (BVN) Project: Chams played a pivotal role in the execution and deployment of identity management solutions for the Central Bank of Nigeria’s BVN project, a multi-million dollar initiative aimed at enhancing the security and efficiency of Nigeria’s banking system.

Market Position

Chams’ diversified services and strategic partnerships have solidified its reputation in Nigeria’s technology sector. The company’s commitment to innovation and customer satisfaction positions it favorably among competitors. Chams is currently the 86th most valuable stock on the Nigerian Stock Exchange, reflecting its established presence in the market.

Conclusion

Chams Holding Company Plc continues to demonstrate resilience and adaptability in Nigeria’s evolving technology landscape. With a focus on identity management, payment solutions, and technological innovation, the company is well-positioned for sustained growth. Investors and stakeholders should monitor Chams’ strategic initiatives and financial performance to assess its long-term value proposition in the competitive technology sector.

Chams Holding Company Plc, formerly known as Chams Plc, is a Nigerian provider of integrated technology solutions, specializing in identity management, payment collections, and transactional systems. Established in 1985, the company has evolved into a key player in Nigeria’s technology sector, offering a diverse range of services through its subsidiaries.

Company Overview

Chams operates through several subsidiaries, each focusing on distinct aspects of technology solutions:

ChamsSwitch: Specializes in remittances, card payment processing, and financial services, providing a robust e-payment platform capable of integrating with various financial systems.

ChamsMobile: Offers mobile money accounts supported by a nationwide financial services agent infrastructure, enhancing financial inclusion across Nigeria.

CardCentre Nigeria Limited (CCNL): Provides comprehensive end-to-end identity management, digital security, and payment solutions, including smart card personalization.

ChamsAccess: Focuses on delivering innovative technology solutions for individuals and businesses, contributing to the group’s diversified service offerings.

Financial Performance

As of February 21, 2025, Chams’ stock price was NGN 2.30, slightly below its 52-week high of NGN 2.53 set on January 6, 2025.

The company’s market capitalization stood at approximately NGN 9.77 billion, representing about 0.017% of the Nigerian Stock Exchange equity market.

In the most recent financial reports, Chams reported a net income of NGN 186.24 million for the last quarter, reflecting a 6.47% increase from the previous quarter’s net income of NGN 174.91 million.

This growth indicates improved profitability and operational efficiency.

Over the past year, Chams’ stock has experienced a slight decrease of 2.08%. However, the company’s stock reached an all-time high of NGN 3.65 on January 19, 2024, and an all-time low of NGN 0.20 on December 12, 2018, showcasing significant volatility over the years.

Strategic Developments

Chams has been actively involved in various strategic initiatives to strengthen its market position:

Identity Management Projects: The company has executed identification and verification projects for major institutions, including the Independent National Electoral Commission (INEC), Nigerian Communications Commission (NCC), National Health Insurance Scheme (NHIS), and the Nigerian Air Force.

Bank Verification Number (BVN) Project: Chams played a pivotal role in the execution and deployment of identity management solutions for the Central Bank of Nigeria’s BVN project, a multi-million dollar initiative aimed at enhancing the security and efficiency of Nigeria’s banking system.

Market Position

Chams’ diversified services and strategic partnerships have solidified its reputation in Nigeria’s technology sector. The company’s commitment to innovation and customer satisfaction positions it favorably among competitors. Chams is currently the 86th most valuable stock on the Nigerian Stock Exchange, reflecting its established presence in the market.

Conclusion

Chams Holding Company Plc continues to demonstrate resilience and adaptability in Nigeria’s evolving technology landscape. With a focus on identity management, payment solutions, and technological innovation, the company is well-positioned for sustained growth. Investors and stakeholders should monitor Chams’ strategic initiatives and financial performance to assess its long-term value proposition in the competitive technology sector.

Learn More about Elliot Wave Theory

Our Clients Reviews

Read what our clients have to say about their experience with EWNation.