Champion Breweries reported robust financial results for the third quarter of 2024. Revenue for the nine months ended September 30, 2024, reached ₦14 billion, marking a 67.63% increase from ₦8.36 billion in the same period of the previous year. Profit before tax stood at ₦178.20 million, while profit after tax was ₦21.50 million. The company's share price was ₦3.75 as of the report date.

Categories

Forex

+-

-

Jun 27, 2025 Premium

Jun 27, 2025 Premium -

Apr 30, 2025 Premium

Apr 30, 2025 Premium

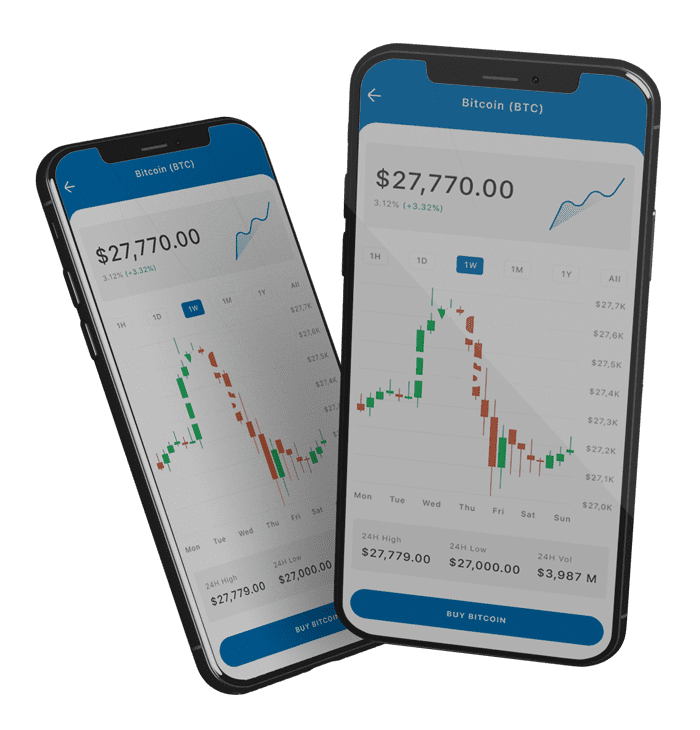

Crypto

+-

Aug 2, 2025 Premium

Aug 2, 2025 Premium -

Jul 31, 2025 Premium

Jul 31, 2025 Premium -

Jul 31, 2025 Premium

Jul 31, 2025 Premium

US Stock

+-

Jul 31, 2025 Premium

Jul 31, 2025 Premium -

Jul 17, 2025

Jul 17, 2025 -

Jul 16, 2025

Jul 16, 2025

NGX Stock

−-

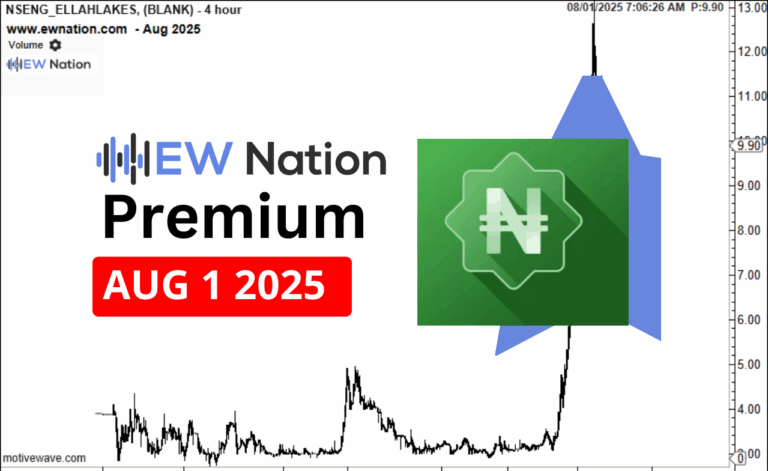

Aug 1, 2025 Premium

Aug 1, 2025 Premium -

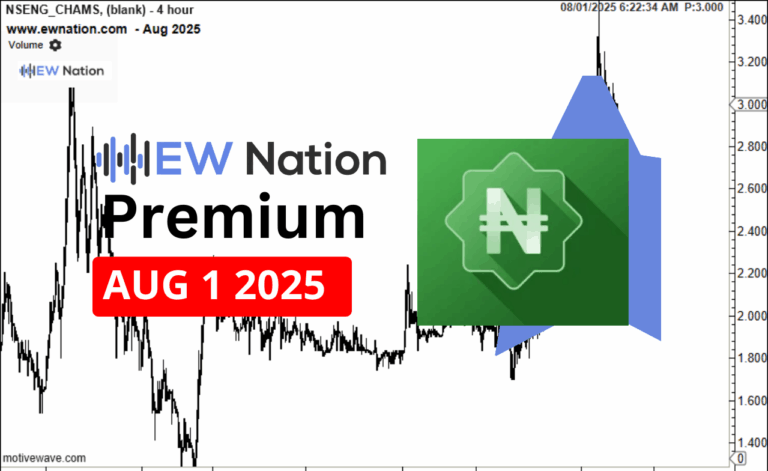

Aug 1, 2025 Premium

Aug 1, 2025 Premium -

Jul 30, 2025 Premium

Jul 30, 2025 Premium

Gold and Silver

+Crude Oil

+-

Aug 6, 2024

Aug 6, 2024

You May

Also

Like

Bonk - July 31 Analysis...

Ellahlakes August 1st Analysis...

Chams is a tightly held tech micro-cap showing signs of stabilization and growth in identity...

Trumpusd - August 1st Analysis...

Learn More about Elliot Wave Theory

Our Clients Reviews

Read what our clients have to say about their experience with EWNation.