Air Transport Services Group Inc. (NASDAQ: ATSG) is a leading provider of air cargo transportation and related services, primarily operating through its subsidiaries, including aircraft leasing and airline operations. Over the past decade, ATSG has experienced significant growth, benefiting from the e-commerce boom and the increasing demand for air freight services. However, like many companies in the transportation and logistics sector, ATSG’s stock has also been subject to notable fluctuations.

A Decade of Growth and Subsequent Volatility

ATSG has seen remarkable growth over the last decade. Back in October 2011, the stock was trading as low as $3.60 per share, reflecting a period of uncertainty in the global economy and the air cargo industry. Fast forward to August 2016, and ATSG shares had surged to around $45.00, driven by the company’s strategic expansion, increased demand for cargo services, and successful partnerships with major e-commerce players like Amazon.

As of now, ATSG’s stock is trading slightly above $36 per share, a considerable drop from its peak. For investors who have been following ATSG’s progress, this decline might appear as an opportunity to “buy the dip,” especially considering the company’s history of robust performance and its strong position in the air cargo market.

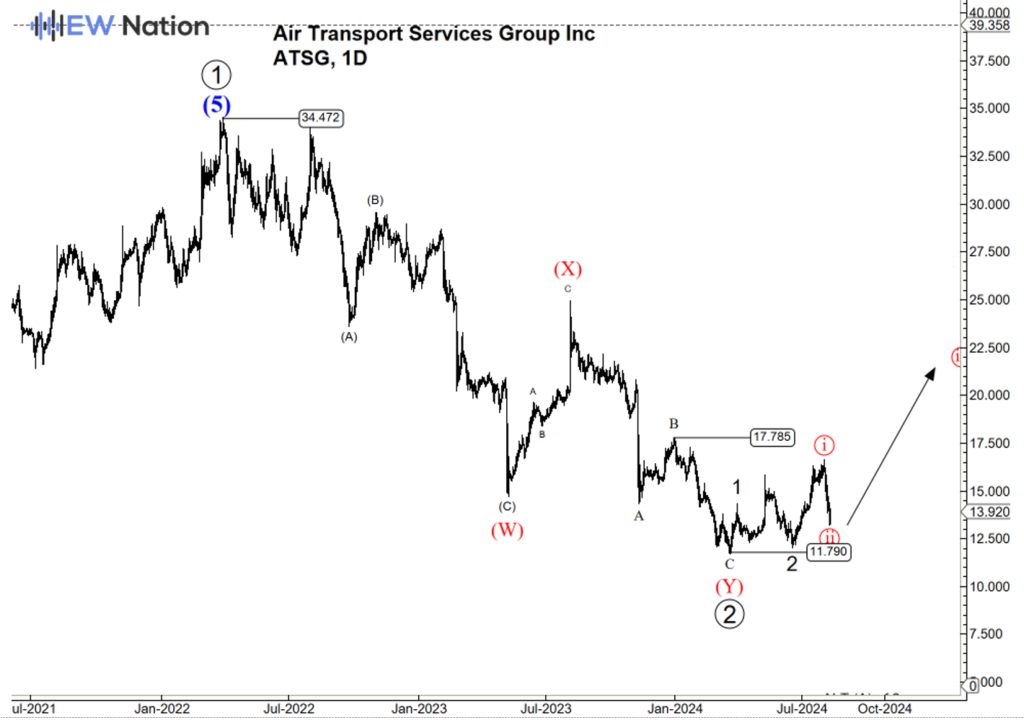

ATSG’s weekly chart shows that the three waves decline from 34.4 following the uptrend may have come to an end at 11.790. This can be the end of Wave 2 or the Wave (A) of 2. We expect to see a recovery taking us above 17.796 in 5 waves impulse.