In its most recent quarterly earnings report, Cameco posted revenue of CAD 482 million, up from CAD 361 million in the same period last year, representing a 33% year-over-year increase

Categories

Forex

+-

-

Jan 2, 2026 Premium

Jan 2, 2026 Premium -

Dec 17, 2025 Premium

Dec 17, 2025 Premium

Crypto

+-

Jan 10, 2026 Premium

Jan 10, 2026 Premium -

Jan 5, 2026 Premium

Jan 5, 2026 Premium -

Jan 4, 2026 Premium

Jan 4, 2026 Premium

US Stock

+-

Jan 22, 2026 Premium

Jan 22, 2026 Premium -

-

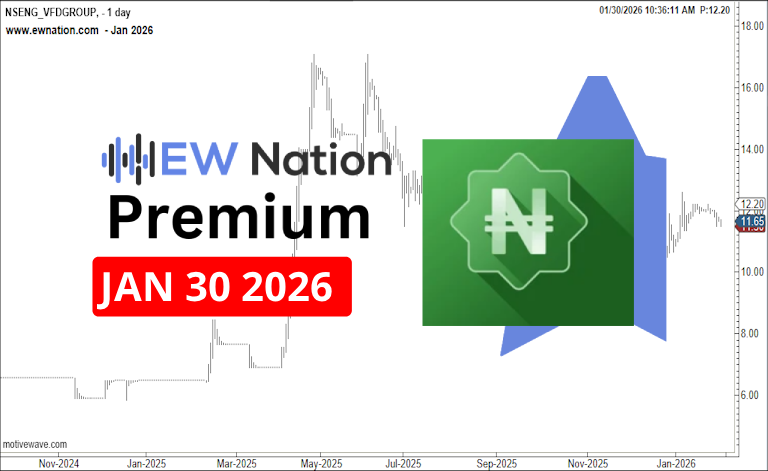

NGX Stock

+-

Jan 30, 2026 Premium

Jan 30, 2026 Premium -

Jan 30, 2026 Premium

Jan 30, 2026 Premium -

Jan 30, 2026 Premium

Jan 30, 2026 Premium

Gold and Silver

+-

Oct 20, 2025 Premium

Oct 20, 2025 Premium -

Sep 6, 2025 Premium

Sep 6, 2025 Premium -

Jul 7, 2025

Jul 7, 2025

Crude Oil

+-

Sep 6, 2025 Premium

Sep 6, 2025 Premium -

Aug 6, 2024

Aug 6, 2024

You May

Also

Like

ConhallPLC December 9th 2025 Update...

Ellahlakes January 30th, 2026 Update...

Daarcom January 30th, 2026 Update...

VFDGroup January 28th, 2026 Update...

Tantalizer January 28th, 2026 Update...

Cutix January 28th, 2026 Update...

Learn More about Elliot Wave Theory

Our Clients Reviews

Read what our clients have to say about their experience with EWNation.