In December 2024, Apple stock fell below the $200 mark in a 33% sell off heralded by Trump administration’s 25% tariff threats on non-U.S.-made iPhones, targeting Apple’s China-centric supply chain and India expansion plans.

These threats, coupled with high U.S. production costs ($3,500 per iPhone) and trade war volatility, wiped out over $770 billion in market cap at times. Despite services growth, AI investments, and supply chain diversification, risks from tariffs, China’s market weakness, and regulatory pressures remain However, even the greatest company can loose money if you buy in at the wrong time. Here, we think that Apple is at a good buy range.

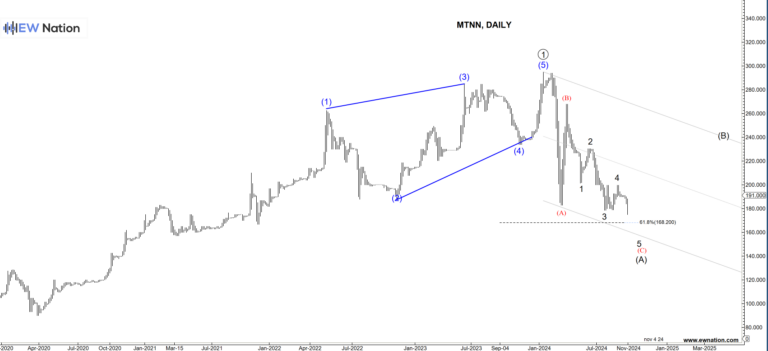

The chart above shows Apple’s progress since the bottom at $171.9 in April 2025. As visible, the stock rallied to $214 could already be seen as a complete five-wave impulse pattern.

According to the Elliot Wave Principle, every impulse is followed by a three-wave correction in the other direction. So, before the uptrend could continue, a noteworthy retracement is likely to occur.

Apple is the biggest company in the world with one of the strongest brands. In the long run, the enterprise is almost certain to continue prospering. But this does not mean that occasional disappointments are impossible.

In our Elliot Wave Premium subscriptions we provide analyses of Cryptocurrencies and forex. Check them out now!