Access Holdings Plc, a leading financial services group in Nigeria, has demonstrated exceptional growth in 2023 and into 2024 despite economic challenges. In our previous coverage of AccessCorp, we highlighted its solid market positioning and expansion strategies. Here’s an updated analysis:

Financial Performance

In 2023, Access Holdings reported a 307% surge in after-tax profit, reaching ₦619.3 billion, compared to ₦152.2 billion in 2022. This remarkable performance was driven by a 99.9% growth in interest income, boosted by higher yields on loans and investment securities. Non-interest income also grew significantly, particularly from trading revenues and fees, underscoring the group’s diversified income base.

Key Operational Metrics

- Net Interest Income: Increased by 93.4% year-on-year, reflecting improved earnings on assets and cost management.

- Loans and Advances: Expanded to ₦747.2 billion in 2023, a growth of 57.6% year-over-year, supported by devaluation effects on foreign currency loans.

- Deposits: Customer deposits grew 65.2% to ₦505.6 billion, showcasing strong trust in the bank’s services.

Strategic Developments

Access Holdings has continued its geographic and product diversification. Key achievements include:

- Expansion in Tanzania and Zambia through the integration of merged entities, enhancing cross-border banking capabilities.

- Accelerated growth in its non-banking subsidiaries, including Access Pensions and Hydrogen Payments, which have contributed significantly to revenue and operational efficiency

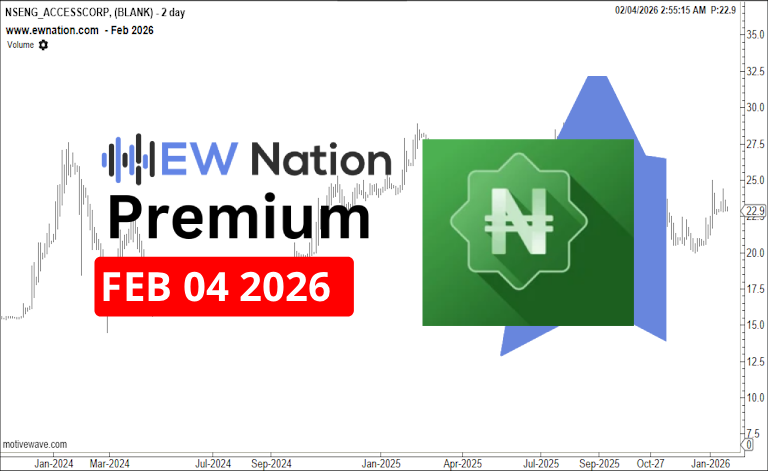

As impressive as Accesscorp results are, the Elliot Wave Chart signifies that we will still expect some correction before the impulse ultimately resumes. Unfolding is a triangle correction with the move from 16 indicating a 3 waves move to form wave B with a target at 28 region. Further downside movement will see wave C correction towards 21 region. Above 29 high will invalidate this count.