Caverton Offshore Support Group (NGX: CAVERTON) is a leading provider of marine, aviation, and logistics services to the oil and gas industry in Nigeria and West Africa. Over the past decade, Caverton has played a crucial role in supporting offshore oil and gas operations, providing essential services such as helicopter transportation and marine logistics. However, like many companies in the energy services sector, Caverton has experienced significant stock price fluctuations due to the volatile nature of the oil market and the broader economic challenges in the region.

A Decade of Growth and Subsequent Volatility

Caverton Offshore Support Group has seen its stock price undergo significant changes over the past decade. Back in October 2011, the stock was trading at relatively low levels, reflecting the uncertainty in the global oil market and the broader economic conditions in Nigeria. By August 2016, shares had surged as the company benefited from increased demand for offshore support services, driven by the recovery in oil prices and the expansion of offshore oil and gas exploration in West Africa.

However, despite this growth, Caverton’s stock has not been immune to the challenges facing the oil and gas industry. As of now, Caverton’s stock is trading significantly below its previous highs, reflecting the impact of the ongoing economic tension in Nigeria, fluctuating oil prices, and operational challenges. For investors who have witnessed the company’s past performance, this decline might seem like an attractive opportunity to “buy the dip,” particularly given the company’s essential role in the energy sector.

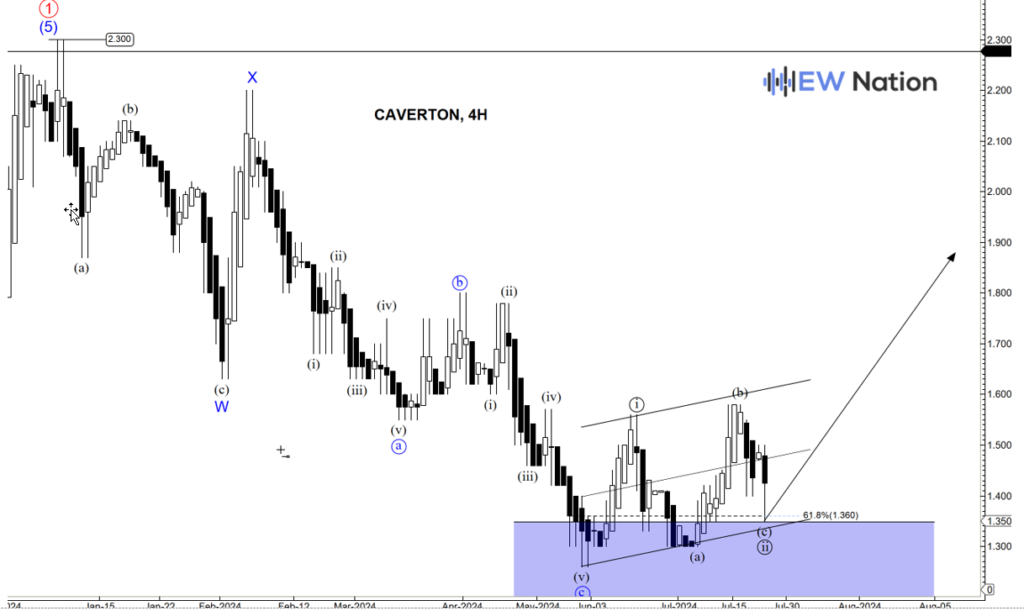

From the Elliot Wave chart, the decline from 2.3 in January 2024, signify a wave 1 top was reached, since then we have seen a 3 wave corrective pattern to 1.35 which is 61.8 ratio of the move from wave 1 top. Subsequently, we expect the impulse to resume, the move 1.35 suggests a wave 1 and 2 pattern and we should be looking up from this region (blue) to surpass 2.3 region.