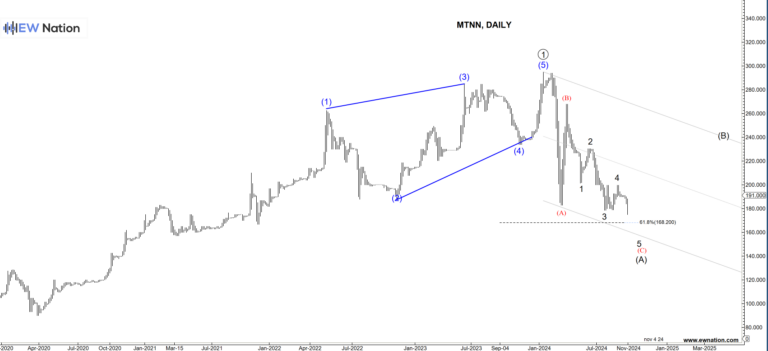

We first mentioned MTNN in October 2024 heralding the ending diagonal that shifted the market from bearish to bullish. Since then MTNN has recovered 64% of its share price and continues to do so.

MTN Nigeria has implemented several strategies to maintain its market leadership and drive share price growth. Its P/E ratio of 42.4x reflects a premium valuation compared to the Nigerian market average of 6.8x and telecom peers, driven by strong Q1 2025 profit growth and investor confidence in its data and fintech strategies. With revenue projected to reach ₦4.9 trillion by year-end 2025, supported by tariff increases, network investments, and financial inclusion initiatives, MTN Nigeria is well-positioned for growth. However, forex risks, regulatory challenges, and high debt levels warrant caution.

From the chart Daily chart, MTNN has completed the wave 1 and the bulls are determined to push the price of this stock further.

Target for wave 3 is ₦319. MTNN has done better than many of its rivals, however, MTNN is not a buy-and-forget stock. Retail trading is a cyclicla business which ebbs and flows with the economic cycle. For instance, it took MTNN 8 painful months for the decline and now its recovery has been for 5 months. So while the recent past saw tremendous growth, it is dangerous to extrapolate it into the distant future. Can the bulls feel safe.

If this count is correct, target for the completion of this wave is ₦11.5.

In our Elliot Wave Premium subscriptions we provide analyses of Cryptocurrencies and forex. Check them out now!