Mastering the Ending Diagonal Pattern: A Guide for Traders

The ending diagonal is a distinctive pattern in Elliott Wave Theory, often signaling the conclusion of a strong price movement. Recognizing this pattern can provide traders with valuable insights into potential market reversals.

What is an Ending Diagonal?

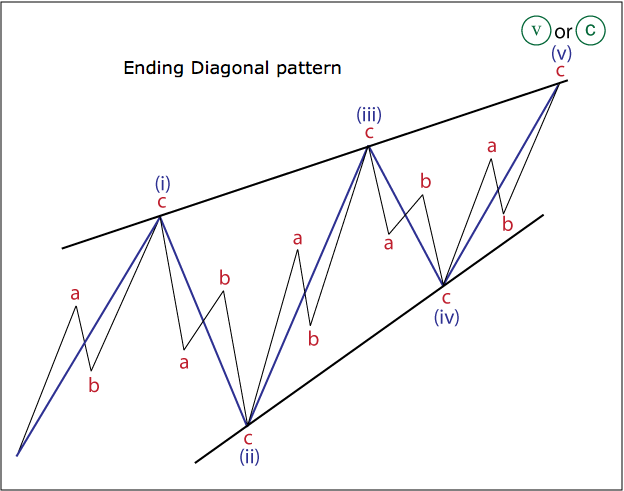

An ending diagonal is a specific type of motive wave that appears in the fifth wave of an impulse or the C wave of a corrective pattern. It typically forms a wedge shape, indicating a slowdown in the prevailing trend and a possible reversal.

Key Rules of the Ending Diagonal

Wave Structure: The pattern consists of five waves, each subdividing into three smaller waves, following a 3-3-3-3-3 structure.

Wave Overlap: Waves 1 and 4 often overlap in price territory, a feature uncommon in standard impulse waves.

Wave Lengths: Wave 3 cannot be the shortest among waves 1, 3, and Trendlines: The pattern is bounded by two converging trendlines, forming a wedge shape.

Throw-Over: Wave 5 may extend beyond the trendline formed by waves 1 and 3, known as a “throw-over,” often followed by a sharp reversal.

Examples of Ending Diagonal Patterns

S&P 500 Index (Wave 5): An ending diagonal formed in the fifth wave, leading to a significant market correction.

2. EUR/USD Currency Pair (Wave C): A bearish ending diagonal in the C wave signaled the end of a corrective phase and the resumption of the downtrend.

3. Gold Prices (Expanding Diagonal): An expanding ending diagonal indicated a reversal point, leading to a new bullish phase.FBS

3. Gold Prices (Expanding Diagonal): An expanding ending diagonal indicated a reversal point, leading to a new bullish phase.FBS

Trading the Ending Diagonal

Entry Point: Consider entering a trade when wave 5 completes, especially if accompanied by a throw-over and divergence in momentum indicators

Stop-Loss: Place stop-loss orders beyond the extremity of wave 5 to manage risk.

Profit Target: Aim for a retracement to the start of the diagonal pattern, as prices often return to this level after completion.

Understanding and identifying the ending diagonal pattern can be a powerful tool in a trader’s arsenal, offering early signals of potential market reversals. By adhering to its defining rules and analyzing real-world examples, traders can enhance their market timing and decision-making strategies.