Categories

Forex

−-

-

Jun 27, 2025 Premium

Jun 27, 2025 Premium -

Apr 30, 2025 Premium

Apr 30, 2025 Premium

Crypto

+-

Jul 13, 2025 Premium

Jul 13, 2025 Premium -

Jul 10, 2025 Premium

Jul 10, 2025 Premium -

Jul 10, 2025 Premium

Jul 10, 2025 Premium

US Stock

+-

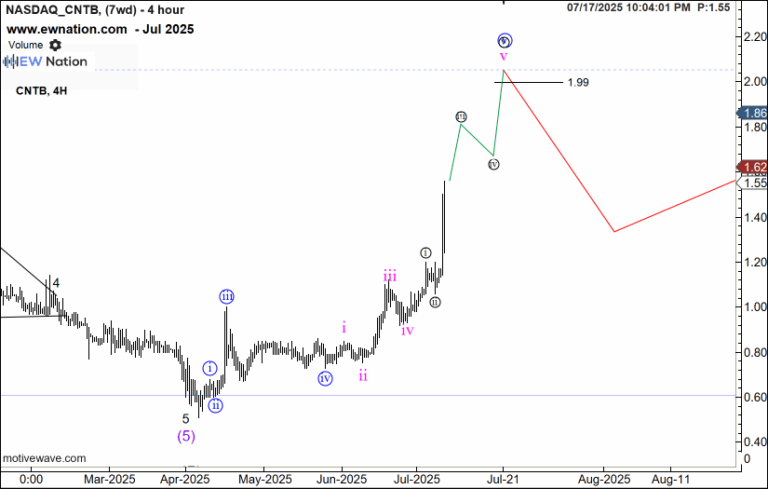

Jul 17, 2025

Jul 17, 2025 -

Jul 16, 2025

Jul 16, 2025 -

Jul 11, 2025 Premium

Jul 11, 2025 Premium

NGX Stock

+-

Jul 26, 2025 Premium

Jul 26, 2025 Premium -

Jul 25, 2025

Jul 25, 2025 -

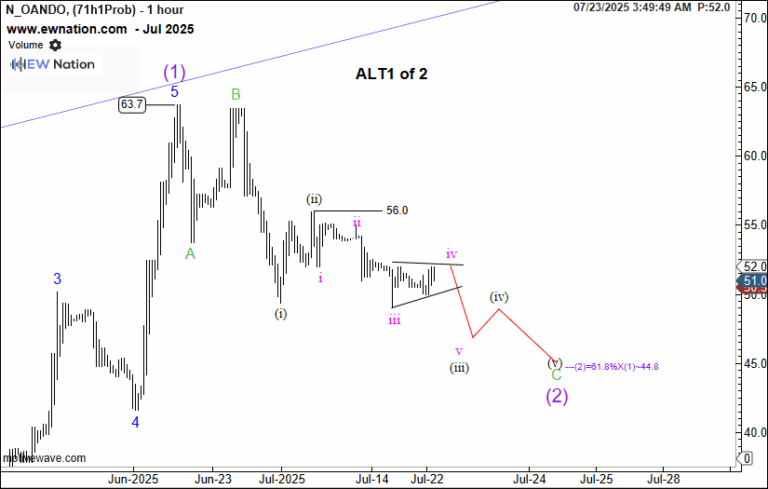

Jul 23, 2025

Jul 23, 2025

Gold and Silver

+Crude Oil

+-

Aug 6, 2024

Aug 6, 2024

The Canadian dollar weakened toward $1.42, retreating from its recent four-month high of $1.41 on April 3rd, amid rising external trade uncertainties and signs of domestic economic fragility. A sharp decline in crude oil prices—falling to a four-year low—has eroded the value of the commodity-linked loonie, as oil remains a key export for Canada. Simultaneously, escalating trade disputes spurred by U.S. President Trump’s tariff measures and China’s retaliatory actions have intensified fears of a global recession, driving investors to seek refuge in the safe-haven U.S. dollar. Domestically, this external headwind was compounded by pessimistic economic data as March employment figures showed a loss of 32,600 jobs and a rise in unemployment to 6.7%, while persistent vulnerabilities in sectors such as auto, steel, and aluminum are pressuring the Bank of Canada toward a more dovish stance. Political uncertainty ahead of the snap election on April 28 further amplifies risk aversion.

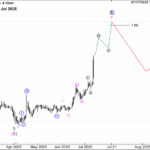

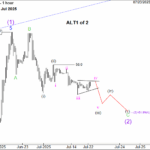

The recent sharp rally suggests that wave (x) of wave I concluded at 1.3093 in July 2023. From that low, a new a)-b)-c) zigzag structure appears to be forming to the upside. With waves a) and b) already completed, it looks like wave c) is currently underway. This final leg is expected to develop as a five-wave impulse, labeled 1-2-3-4-5.

Last week’s decline revealed that the previous labeling of wave 4 was premature. However, since USDCAD did not break below the wave 1 high at 1.3947, and instead rebounded to close above 1.4230 on the weekly chart, the short-term bullish outlook remains valid. As long as the key support at 1.4028 holds, the scenario remains intact. Under this wave structure, upside targets near 1.5000 are still achievable within wave 5 of c) of (y) of wave I.

Learn More about Elliot Wave Theory

Our Clients Reviews

Read what our clients have to say about their experience with EWNation.