Champion Breweries Plc (NGX: CHAMPION), a key player in Nigeria’s beverage industry, has steadily expanded its market presence despite economic pressures and industry competition. The company, known for its premium beer and malt products, has leveraged strategic partnerships and operational efficiencies to drive revenue growth.

In its latest financial results, Champion Breweries reported a revenue increase of ₦11.8 billion for the first nine months of 2024, reflecting a 9.3% growth year-over-year. However, net profit has remained under pressure due to rising production costs, inflation, and currency devaluation. The company’s net profit margin stands at 8.2%, slightly below last year’s levels, signaling the impact of higher input costs.

Champion Breweries has benefited from its affiliation with Heineken N.V., which owns a significant stake through its Nigerian subsidiary, Consolidated Breweries. This backing provides financial stability and access to global best practices in brewing technology and distribution. The company has also expanded its production capacity and distribution network across Nigeria, helping it compete with larger players like Nigerian Breweries and International Breweries.

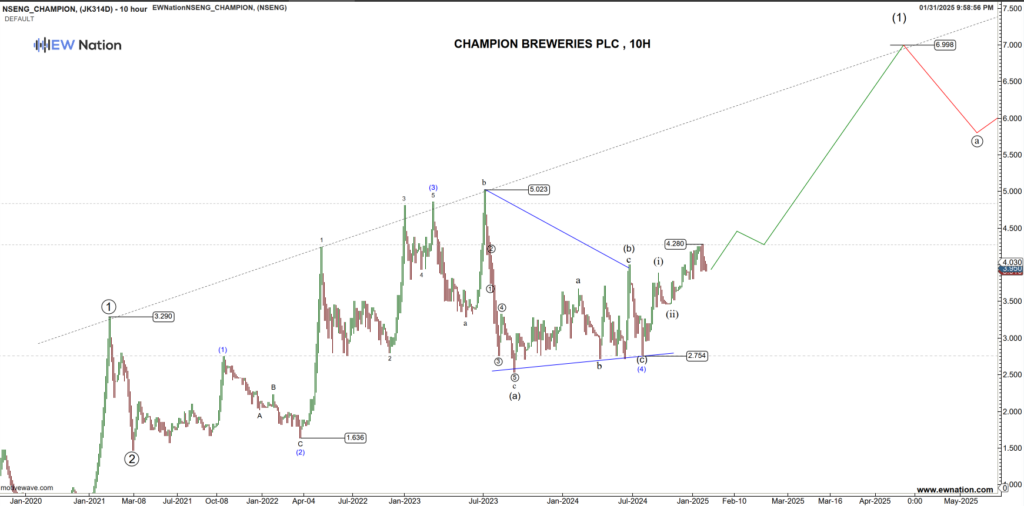

Champion Breweries’ stock has experienced volatility, currently trading around ₦3.95, with key resistance at ₦5.10 and support at ₦3.470. The stock has gained 15% year-to-date, reflecting investor confidence despite broader market challenges. Analysts suggest that breaking above the ₦5.10 resistance could trigger further upside, while failure to hold support may lead to a price correction.

While Champion Breweries faces macroeconomic headwinds, its strategic positioning, operational improvements, and backing from Heineken provide long-term growth potential. Investors should watch upcoming financial results and market trends to assess its continued resilience in Nigeria’s competitive beer industry.

The Elliot wave chart above shows that Champion Breweries PLC is in a nested Elliot wave impulse pattern with the asset currently in the sub wave 5. Key resistance is 5.023 which is Wave B of 3.

If the count is correct, according to the theory, impulses develop in the direction of the larger trend, we expect a target that surpasses 5.023, typically around the is 6.5 to 7 ranges for wave 1.