Categories

Forex

+-

-

Jun 27, 2025 Premium

Jun 27, 2025 Premium -

Apr 30, 2025 Premium

Apr 30, 2025 Premium

Crypto

+-

Jul 13, 2025 Premium

Jul 13, 2025 Premium -

Jul 10, 2025 Premium

Jul 10, 2025 Premium -

Jul 10, 2025 Premium

Jul 10, 2025 Premium

US Stock

+-

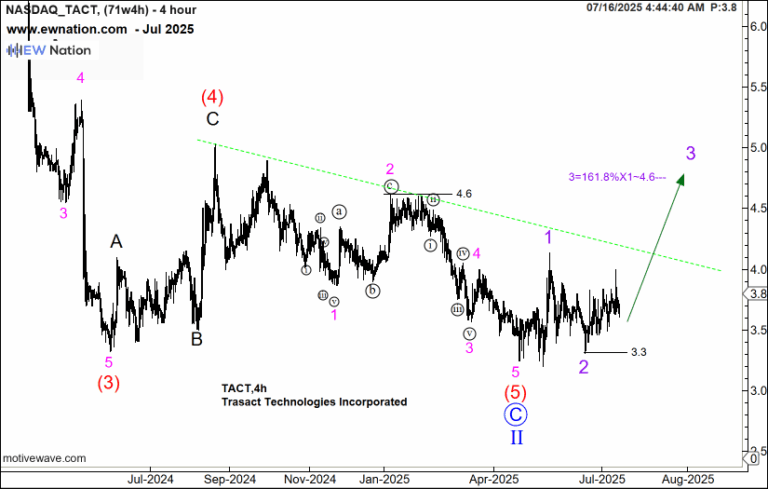

Jul 16, 2025

Jul 16, 2025 -

Jul 11, 2025 Premium

Jul 11, 2025 Premium -

Jul 7, 2025

Jul 7, 2025

NGX Stock

−-

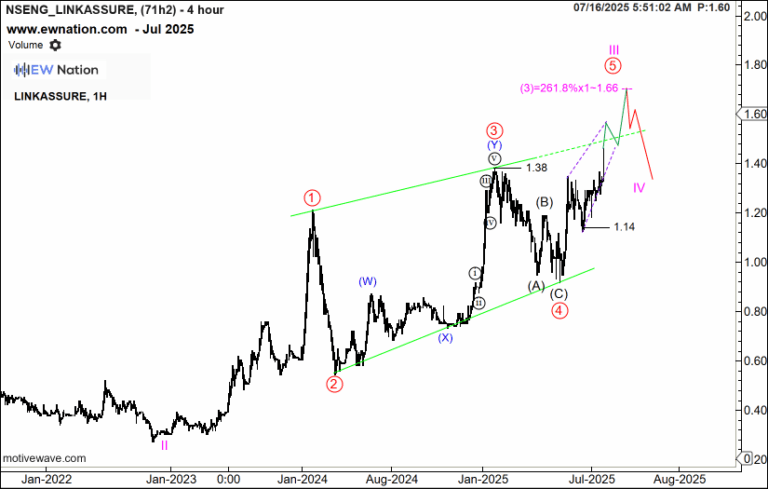

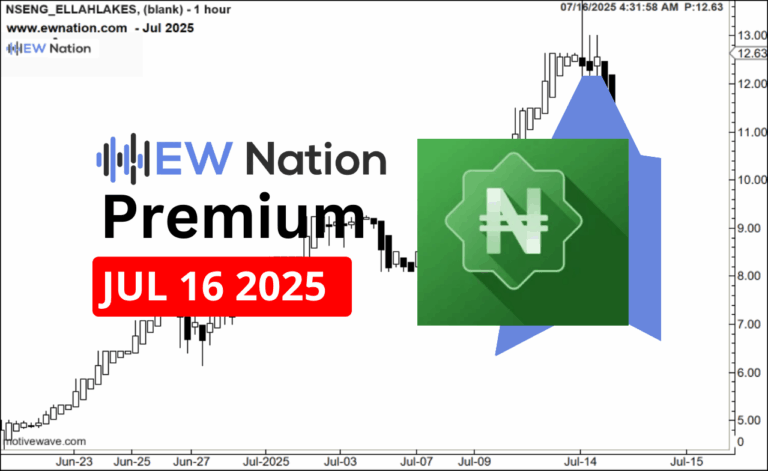

Jul 16, 2025 Premium

Jul 16, 2025 Premium -

Jul 16, 2025 Premium

Jul 16, 2025 Premium -

Jul 16, 2025

Jul 16, 2025

Gold and Silver

+Crude Oil

+-

Aug 6, 2024

Aug 6, 2024

We first discussed Ellah Lakes Plc on December 2, 2024 (EllahLakes Impending Reversal), noting its focus on agricultural development and sustainable farming despite operational challenges. The company’s most recent earnings report for the fiscal year ending July 31, 2024, underscores both the opportunities and headwinds it faces.

Ellah Lakes reported revenue of ₦1.2 billion, marking a 6% year-over-year increase, driven by agricultural diversification efforts. However, rising operational costs and supply chain inefficiencies pushed the company to a ₦110 million loss after tax, compared to a narrower loss in the previous fiscal period. The cost-to-revenue ratio remains high, reflecting ongoing inflationary pressures and logistical hurdles in Nigeria.

Ellah Lakes maintains a debt-to-equity ratio of 0.6, indicating a balanced but cautious approach to leveraging for growth. Management continues to emphasize improving production efficiency and pursuing partnerships to diversify its agribusiness portfolio. Notably, efforts to integrate renewable energy into operations align with its sustainability focus and could enhance long-term cost efficiency.

The company’s stock has seen mixed performance in the market. Over the past six months, the share price gained 12.6%, reflecting investor optimism around its strategic initiatives, while the year-to-date increase stands at 16.9%, driven by growing interest in Nigeria’s agricultural sector. Technical indicators suggest the stock is consolidating, with potential upside contingent on operational improvements.

While profitability challenges remain, Ellah Lakes’ commitment to innovation and sustainability could drive its long-term prospects. Investors will be closely monitoring its execution on cost management and strategic partnerships to gauge its ability to deliver a financial turnaround.

The Elliot Wave chart above has been represented from the previous post of December 2, 2024 (EllahLakes Impending Reversal). We now think that EllahLakes has printed a 1 2, 1 2 nested impulse wave rather than a Wave 4 . We still look upwards for the continuation of the wave 1 of larger Wave 3 or a Wave B of a sustained continuation pattern. Initial target around the 3.8 NGN region.

Learn More about Elliot Wave Theory

Our Clients Reviews

Read what our clients have to say about their experience with EWNation.