The substantial revenue growth is attributed to increased dispatch volumes and strategic market expansion. BUA Cement achieved a 7.3% rise in dispatch volumes, delivering 6.7 million metric tons in 2023, up from 6.3 million metric tons in 2022. This expansion bolstered the company’s market share to 24%, an increase from 21% in the prior year.

However, the company faced escalating production costs due to the devaluation of the Naira and rising inflation. Cost of sales surged by 115.9% to ₦402.59 billion, impacting profit margins. Additionally, a net foreign exchange loss of ₦70 billion was recorded, with ₦52.5 billion attributed to finance costs related to the construction of new production lines.

In line with its expansion strategy, BUA Cement commissioned new 3 million metric tons per annum (mmtpa) lines at its Sokoto and Obu plants, increasing total production capacity to 17 mmtpa. The company also activated a 70MW gas power plant in Sokoto and plans to commission a similar facility in Obu in the first quarter of 2024. Furthermore, over 500 new trucks were procured to enhance distribution capabilities, reinforcing BUA Cement’s commitment to meeting Nigeria’s housing and infrastructure needs sustainably.

Despite the challenges posed by currency devaluation and inflation, BUA Cement’s strategic investments in capacity expansion and operational efficiency position it favorably for future growth. The company’s focus on leveraging domestic resources and reducing reliance on external power sources is expected to mitigate some of the economic pressures, supporting sustained profitability in the coming years.

BUA Cement’s performance underscores its resilience and strategic foresight in navigating a challenging economic landscape, maintaining its trajectory towards market leadership in Nigeria’s cement indus

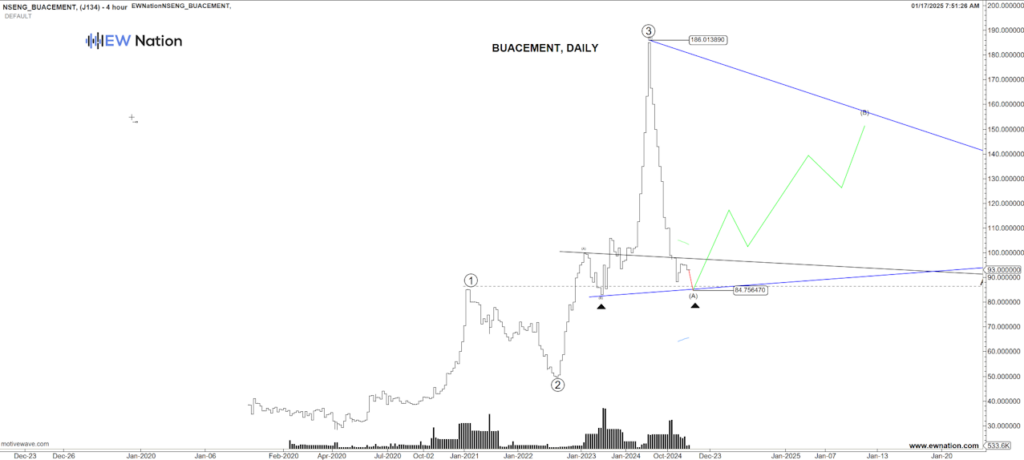

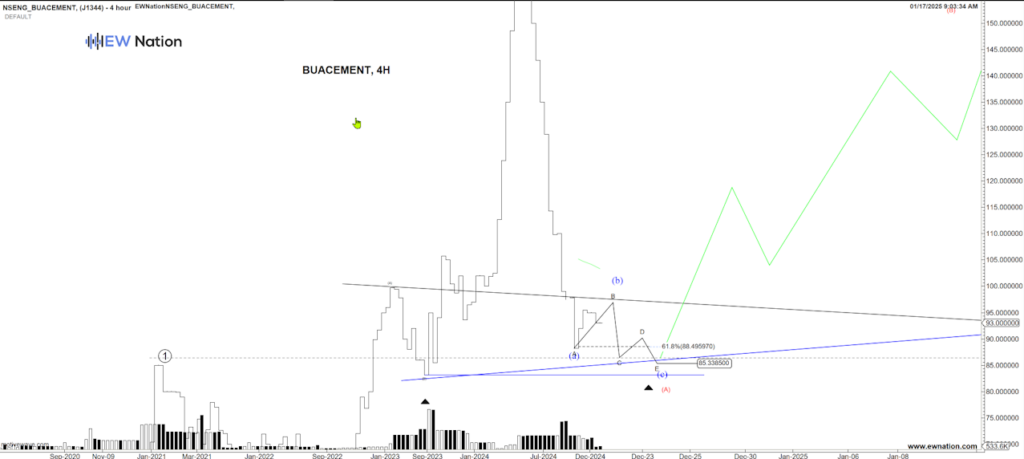

BUACEMENT completed Wave A of an ABC correction. We are looking lower for the B and C waves potentially ending around 61.8 fibonacci region within the ranges of 85.3 and 88.4 NGN.

If this count is correct, then we expect to have a reversal to commence wave B or a larger degree.