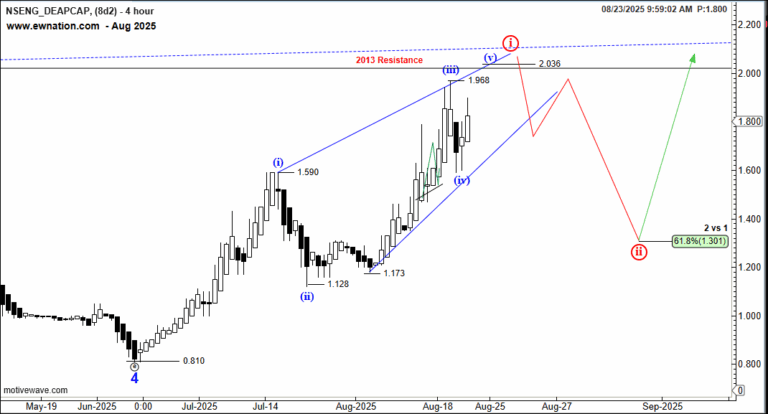

Afriprud completed a leading diagonal for wave 1 (blue) in diagram 1 above. The Elliot Wave chart above shows that sub wave 1 has unfolded, next is the wave 3 or a nested wave 1. In both cases, we should be looking higher as long as 9NGN holds.

Categories

Forex

+-

-

Aug 15, 2025 Premium

Aug 15, 2025 Premium -

Aug 14, 2025 Premium

Aug 14, 2025 Premium

Crypto

+-

Aug 23, 2025 Premium

Aug 23, 2025 Premium -

Aug 20, 2025 Premium

Aug 20, 2025 Premium -

Aug 17, 2025 Premium

Aug 17, 2025 Premium

US Stock

+-

Aug 21, 2025 Premium

Aug 21, 2025 Premium -

Aug 15, 2025 Premium

Aug 15, 2025 Premium -

Aug 5, 2025

Aug 5, 2025

NGX Stock

+-

Aug 26, 2025 Premium

Aug 26, 2025 Premium -

Aug 26, 2025 Premium

Aug 26, 2025 Premium -

Aug 25, 2025 Premium

Aug 25, 2025 Premium

Gold and Silver

+Crude Oil

+-

Aug 6, 2024

Aug 6, 2024

You May

Also

Like

Pharmdeko August 26th 2025 Update...

FTNCOCOA August 26th 2025 Update...

DangSugar August 26th 2025 Update...

JapaulGold August 25th 2025 Analysis...

Oando August 25h 2025 Update...

DEAPCAP, a high risk speculative asset, offers price appreciation potential, evidenced by strong...

Learn More about Elliot Wave Theory

Our Clients Reviews

Read what our clients have to say about their experience with EWNation.