CWG Plc (Computer Warehouse Group) has enjoyed a strong 2024 so far, with the stock up approximately 30%, handily outperforming the general market. Despite this surge, CWG shares remain below their historical highs, reflecting a broader trend where technology service providers face pressure to translate demand into consistent growth.

A deeper look at CWG’s financials reveals mixed results. Over recent years, CWG’s revenue growth has been moderate, with free cash flow fluctuating due to rising operating costs and competitive pressures within the African tech market. While CWG’s service portfolio includes telecoms, enterprise IT solutions, and managed services, the company’s Q4 guidance projects modest revenue growth, with stable Gross Merchandise Volume (GMV) in its service transactions. This suggests limited organic growth in the near term, despite the rising demand for digital transformation services across sectors.

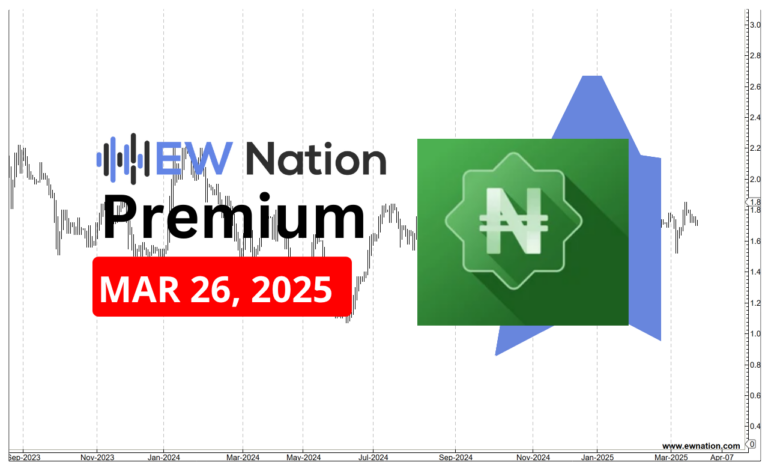

Given these dynamics, CWG’s recent price increase appears driven more by multiple expansion than underlying earnings growth. Essentially, the market is currently assigning a higher premium to the stock in anticipation of future success, a sentiment that is largely sensitive to market conditions and investor expectations. Technical indicators, including Elliott Wave analysis, suggest that CWG’s stock might encounter resistance as we head into the final months of the year, potentially putting a damper on its recent rally.

In summary, CWG Plc’s stock performance this year highlights investor optimism, yet it may not be fully grounded in strong fundamentals. For those considering an investment, the current share price may reflect a sentiment-driven high rather than a sustainable valuation. Savvy investors may want to watch for more tangible growth initiatives from CWG before committing to a long-term position.

The Elliot Wave chart below shows that CWG remains in a sideways correction. Wit the structure printing A-B-C of a corrective triangle. We expect that CWG will progress to complete this pattern further printing D -E. Conversely, the move from 5.2 looking appears to be a 3 wave move with a potential short term target around the 7 region.