The Australian dollar (AUD) and the US dollar (USD) have always reflected a unique interplay of global market sentiment, commodity prices, and interest rate differentials. As 2024 unfolds, the AUD/USD pair sits in an especially pivotal position, influenced not only by domestic data out of Australia and the U.S. Federal Reserve’s ongoing policies but also by an unexpected potential: the return of Donald Trump to the White House. Let’s take a look at the technical and fundamental factors shaping this pair and how a Trump win might affect it in the months ahead.

Technical Analysis of AUD/USD

-

Current Price Levels and Key Support and Resistance Zones

- The AUD/USD is currently trading around 0.6500. Historically, AUD/USD has shown strong support at 0.6200, a level it tested last year and bounced off, suggesting solid buying interest near these lows.

- Key resistance sits around 0.6500-0.6550. Breaking above this zone could open the way to further gains towards 0.6700. However, this resistance will likely require sustained momentum and positive fundamental catalysts to breach effectively.

-

Moving Averages

- The AUD/USD pair recently found itself below the 50-day moving average, which is typically a bearish sign, suggesting that sellers are currently in control. If the pair fails to regain this level in the near term, it could open the door to further downside moves.

- The 200-day moving average, often seen as a long-term trend indicator, is also above the current price, reinforcing the bearish outlook unless AUD/USD stages a significant rally.

-

RSI and MACD Indicators

- The Relative Strength Index (RSI) is currently around the 40 mark, indicating that the pair isn’t in overbought or oversold territory. A drop below 30 would signal oversold conditions and a potential buying opportunity.

- Meanwhile, the Moving Average Convergence Divergence (MACD) indicator recently turned negative, hinting at increased bearish momentum.

Fundamental Factors Impacting AUD/USD

-

Interest Rate Differentials

- The Reserve Bank of Australia (RBA) and the Federal Reserve have taken divergent paths in recent months, with the Fed hiking rates aggressively while the RBA has taken a more cautious approach. This rate disparity has widened the interest rate differential, making the USD more attractive as a higher-yield currency and thereby adding downward pressure on AUD/USD.

-

Commodity Prices and Economic Data

- Australia’s economy is heavily tied to its export of raw materials, especially iron ore. Any fluctuation in commodity prices, particularly driven by China’s demand for Australian exports, can greatly affect AUD/USD. Recently, concerns about slower growth in China have weighed on AUD demand.

-

China’s Economic Growth

- China is Australia’s largest trading partner, and any significant slowdown or stimulus in China’s economy typically impacts the Australian dollar. Weakening Chinese economic data often dampens demand for Australian exports, further pressuring the AUD/USD pair downward.

The Trump Factor: What a Potential 2024 Win Could Mean

As Donald Trump gains traction in the 2024 U.S. presidential race, many are starting to assess the potential market impact of a second Trump presidency. His policies, if similar to those seen during his first term, could have implications for AUD/USD.

-

Trade Policies and Commodity Markets

- Trump’s past approach included protectionist trade policies, notably tariffs on Chinese goods. If re-elected, Trump could return to a more confrontational stance with China, impacting global trade. For AUD/USD, this could mean increased volatility. Australia’s economy relies heavily on trade with China, so any slowdown or tension could negatively impact the AUD and, consequently, the AUD/USD pair.

-

Potential for a Stronger USD

- Trump’s policies have historically been dollar-positive, as his administration sought to make the U.S. economy more competitive. A resurgence in USD strength would add further pressure on AUD/USD, especially if Trump’s economic measures strengthen the U.S. dollar by enhancing domestic manufacturing or spurring economic growth.

-

Market Sentiment and Risk Aversion

- Trump’s tenure brought heightened volatility to financial markets due to unpredictable policy moves. A second Trump administration could revive similar uncertainties, likely impacting global risk sentiment. Since the Australian dollar is often seen as a risk-sensitive currency, any increase in global uncertainty would likely weigh on AUD/USD.

Potential Scenarios to Watch

-

Scenario 1: Trump Wins with Aggressive Trade Stance

- If Trump wins and reintroduces tariffs or takes a hard stance on China, AUD could face downward pressure, especially if commodity demand from China slows as a result. In this scenario, the AUD/USD could test lows last seen in the mid-0.6000 range.

-

Scenario 2: Trump Presidency Boosts USD with Pro-Growth Policies

- If Trump’s policies lead to a stronger U.S. dollar, the interest rate differential between the U.S. and Australia could widen even further, drawing capital toward the USD and away from riskier currencies like the AUD. This would likely push AUD/USD lower as well.

-

Scenario 3: Risk Sentiment and Volatility Rise

- Should a Trump victory stoke market uncertainty, the AUD, being risk-sensitive, could depreciate as investors seek safe-haven assets like the USD.

The AUD/USD pair is navigating a complex environment influenced by both technical signals and fundamental factors, from interest rate policies and commodity prices to potential shifts in U.S. politics. A Trump victory could introduce new dynamics, possibly tipping the balance towards a stronger USD, a bearish AUD, and heightened volatility.

For investors and traders, staying alert to shifts in market sentiment, interest rate differentials, and Trump’s election prospects will be essential for navigating this pair effectively in the coming months.The Australian dollar fell more than 1% on Wednesday, dipping to around $0.655 and nearing three-month lows as the US dollar strengthened after former President Donald Trump took an early lead against Vice President Kamala Harris in the US presidential race. The results have so far followed expectations, with the outcome now focusing on seven key swing states. On the domestic front, the Reserve Bank of Australia kept the cash rate unchanged at 4.35% on Tuesday, marking its eighth consecutive meeting without a rate change, as widely anticipated. RBA Governor Michele Bullock reinforced the hawkish tone, indicating that monetary policy should remain restrictive in light of ongoing inflation risks and a resilient labor market. Meanwhile, data on Wednesday showed that Australia’s industrial sector contracted further in October, marking the 30th consecutive month of declining activity.

The Australian dollar fell more than 1% on Wednesday, dipping to around $0.655 and nearing three-month lows as the US dollar strengthened after former President Donald Trump took an early lead against Vice President Kamala Harris in the US presidential race. The results have so far followed expectations, with the outcome now focusing on seven key swing states. On the domestic front, the Reserve Bank of Australia kept the cash rate unchanged at 4.35% on Tuesday, marking its eighth consecutive meeting without a rate change, as widely anticipated. RBA Governor Michele Bullock reinforced the hawkish tone, indicating that monetary policy should remain restrictive in light of ongoing inflation risks and a resilient labor market. Meanwhile, data on Wednesday showed that Australia’s industrial sector contracted further in October, marking the 30th consecutive month of declining activity.

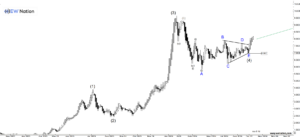

The Elliot Wave chart above shows that AUDUSD could see further sell pff and potentially a 5 waves to the downside.